Pound Sterling declines against US Dollar amid caution ahead of US PCE inflation

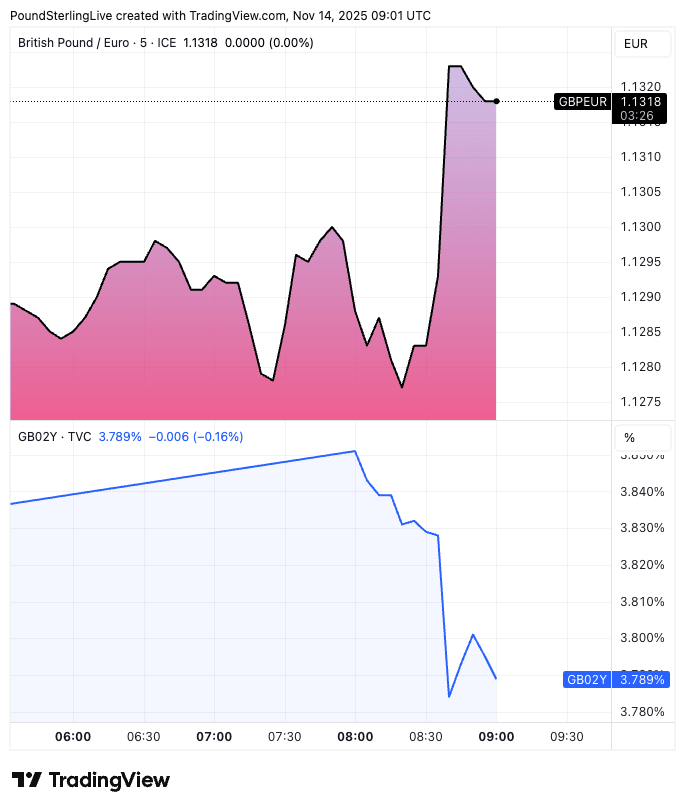

The Pound Sterling (GBP) exhibits a mixed performance against its major peers in Wednesday’s European trading hours. The British currency is expected to trade broadly sideways as investors look for fresh cues about the Bank of England’s (BoE) interest rate path.

The BoE cut interest rates by 25 basis points (bps) to 5% in August, ending its two-and-a-half year-long restrictive monetary policy stance, as officials gained confidence that price pressures will return to the bank’s target of 2% sustainably. Read more…

GBP/USD Forecast: Sellers could take action if Pound Sterling breaks below 1.3200

GBP/USD stays under modest bearish pressure and declines toward 1.3200 after touching its highest level since March 2022 above 1.3260 on Tuesday. In the absence of high-impact macroeconomic data releases and fundamental developments, investors could pay close attention to the pair’s technical conditions.

Following a quiet European session on Tuesday, GBP/USD gained traction in the second half of the day and closed in positive territory, supported by the improving risk mood. US stock index futures trade flat during the European trading hours on Wednesday, failing to provide a clue regarding the risk mood. Read more…