The British pound fell below the 1.30 level against the dollar after weak inflation data across indicators. This sent the pound to a two-month low on speculation that the Bank of England will cut interest rates further in the coming months.

The consumer price index changed little in September, slowing to its slowest pace since April 2021 at 1.7% year-on-year from 2.2% previously and 1.9% expected. Price growth was below the Bank of England’s 2% target, allowing for an acceleration of policy easing to stimulate the economy. The core consumer price index last month was 3.2% higher than a year earlier, down from 3.6% in August. And it has been the lowest since September 2021.

Another bearish factor for the pound is the acceleration of the decline in producer prices. The Input Producer Price Index lost 1% over the month after five months of continuous decline of 2.5% and 2.3% over the past year. The output PPI lost 0.5% in September, after 0.4% previously, bringing the annual trend back into negative territory at -0.7%. In both cases, the figures were well below average expectations.

Only house prices managed to beat expectations, accelerating from 1.8% y/y to 2.8% y/y in August instead of the expected 2.5%. Still, this acceleration was at least partly because of the low base that lasted until last December.

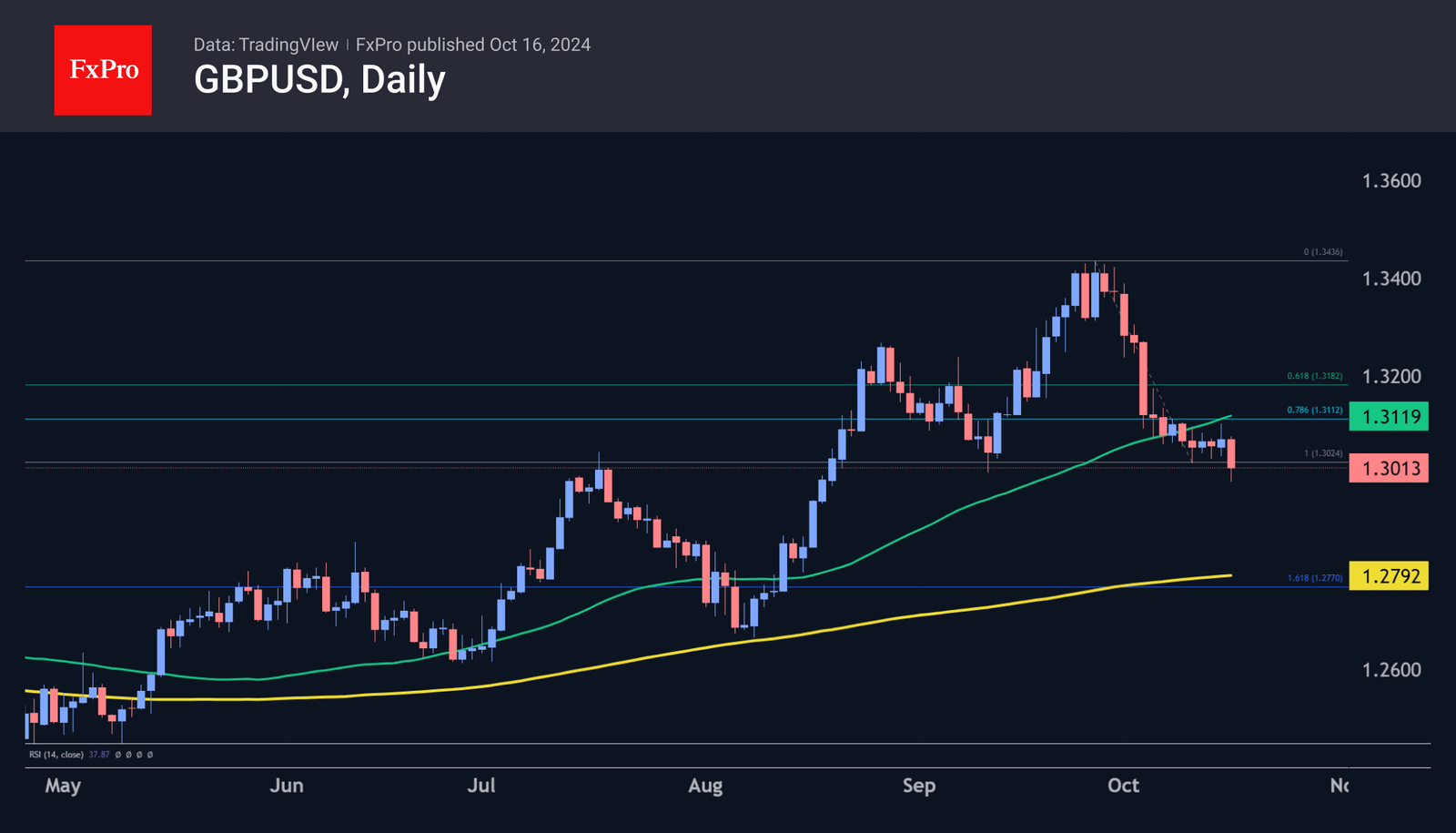

GBPUSD downplayed the news classically, with an impressive sell-off of 0.7% within an hour of the data release. The pound briefly dipped below 1.30, a key round level, where it found buyers. Sterling also predictably rebounded from the previous day’s upbeat employment data but failed to convert the rebound into gains.

GBPUSD met strong technical resistance at 1.3110, where the 50-day moving average and the first correction retracement (of decline from 26 September to 10 October) are centred. The pair also fell below the area of the local lows from 11 September, which gives the sellers the upper hand.

A potentially important downside target is the 1.2800 area, near the 161.8% Fibonacci extension level from the initial decline and the 200-day moving average.

The FxPro Analyst Team