Cable fell to the lowest in almost 2 ½ months on Wednesday, extending a steep fall from 1.3588 (July 24 lower top) into fifth straight day.

Sterling is likely to weaken more as recent much better than expected US economic data (ADP private sector employment and Q2 GDP) suggest that US economy remains in good shape that supports Fed’s current stance on keeping monetary policy unchanged and provide further support to US dollar.

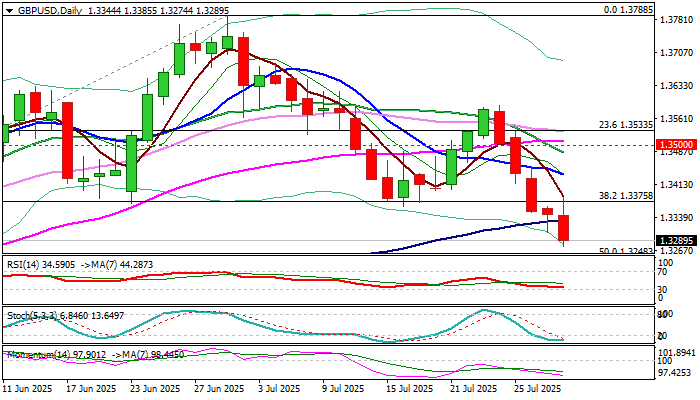

Technical picture on daily chart has weakened further on completion of Head and Shoulders pattern (Monday’s break below the neckline), today’s break below the base of ascending daily Ichimoku cloud (1.3354) and break below 100DMA (1.3330).

Daily moving averages turned into almost full bearish setup, while 14-d momentum continues to travel deeper in the negative territory.

Bears pressure Fibo support at 1.3248 (50% retracement of 1.2708/1.3788 bull-leg), where headwinds are likely to be faced, due to oversold Stochastic.

Upticks should be limited and mark positioning for fresh push lower, as pound’s sentiment remains negative.

Fed ends its two-day policy meeting today and will, according to the latest favorable US economic data, likely keep its policy unchanged that would provide further support to the dollar.

Violation of 1.3248 Fibo level to open way for extension towards 1.3139/20 (May 12 trough / Fibo 61.8%) which guard psychological 1.30 support.

Upticks should be ideally capped at 1.3365/45 zone (former base / broken H&S neckline / broken Fibo 38.2%) to keep bears intact.

Res: 1.3330; 1.3375; 1.3435; 1.3500

Sup: 1.3248; 1.3200; 1.3139; 1.3120