But it wasn’t just the US dollar. Between November 21 and November 28, the rupee’s exchange rate weakened against the dollar (from 88.64 to 89.46) and also the euro (102.32 to 103.63), the British pound (116.08 to 118.27) and the Japanese yen (0.5642 to 0.5720).

The depreciation has been higher over a one-year period since November 28, 2024 — from 84.49 to 89.46 against the dollar, 89.12 to 103.63 against the euro, 106.97 to 118.27 against the pound and 0.5574 to 0.5720 against the yen.

Thus, the rupee has fallen against all the four major currencies — more against the euro and pound than against the dollar.

Effective exchange rates

A better idea of the rupee’s weakening in the last one year can be obtained from the movements in its so-called nominal effective exchange rate (NEER) and real effective exchange rate (REER).

The NEER and REER are indices similar to the consumer price index (CPI). The CPI is the weighted average retail price of a representative consumer basket of goods and services for a given month or year, relative to a fixed base period.

The NEERs/REERs are indices of the weighted average of the rupee’s exchange rates vis-à-vis the currencies of India’s key trading partners. In this case, the basket comprises 40 currencies and the base year (used as a reference for comparison with its value set at 100) is taken as 2015-16. The currency weights are derived from the share of the individual countries in India’s total foreign trade, just as the weight of each commodity in the CPI is based on its relative importance in the overall consumption basket. The 40 currencies are of countries accounting for about 88% of India’s annual trade flows.

Story continues below this ad

Any increase in the NEER/REER indicates the rupee’s effective appreciation against the 40-currency basket and decreases point to its overall exchange rate depreciation.

Falling trend since 2025

The accompanying chart shows movements in the rupee’s NEER and REER from 2022.

The NEER index has ruled below 100 since 2018-19. A value of 90 means that the rupee has fallen relative to the currencies of India’s main trading partners by 10% since 2015-16.

However, it is significant that the NEER hovered above 90 till the start of this calendar year. Between January 2022 and January 2025, the decline was a mere 3.4%, from 93.94 to 90.75. Subsequently, the drop has been marked, to 84.58 in October 2025 — or by 6.8% over just nine months.

Story continues below this ad

The extent of the rupee’s recent depreciation is even more if one looks at the REER. The NEER is a summary index capturing movements in the external value of the rupee against a basket of global currencies. But it doesn’t factor in inflation: If a currency’s nominal exchange rate falls less than the domestic inflation rate, it has actually appreciated in “real” terms.

The REER is basically the NEER index adjusted for the inflation differentials between the home country and its trading partners. The REER is, in that sense, a true gauge of whether a currency is undervalued, overvalued or fairly valued relative to that of other countries, after taking into consideration both exchange rate and relative price movements. If the rupee’s nominal exchange rates stay the same, but prices in India rise faster than in other countries, the REER goes up, making Indian products relatively more expensive and less competitive in the global market.

From the chart, it can be seen that the REER index, in fact, soared to an all-time-high of 108.06 in November 2024. From that peak, it has plunged by 9.8% to 97.47 in October 2025. In other words, from being highly overvalued, the rupee is undervalued today.

There are two reasons why this has happened.

The first is the rupee’s general weakening against most international currencies, including the Chinese yuan (from 11.66 to 12.63 in the last one year). The NEER’s dipping below 85 is a reflection of the overall nominal depreciation.

Story continues below this ad

The second has to do with inflation. Year-on-year CPI inflation in October 2025 for India, at 0.25%, was lower than the latest rates for the US and Japan (3% each), United Kingdom (3.6%), Euro Area (2.1%), Indonesia (2.9%) and Brazil (4.7%). The combination of nominal depreciation with unusually low CPI inflation (sub-3% since May 2025) is what has pushed the REER index to below 100, resulting in an undervalued rupee.

Looking ahead

The International Monetary Fund (IMF) has, in a staff report released on November 26, reclassified India’s exchange rate regime as a “crawl-like arrangement”. This is after having moved it from “floating” to “stabilised” in November 2023.

The “stabilised arrangement” classification was made citing the Reserve Bank of India’s (RBI) frequent interventions in the foreign exchange market to limit any excessive depreciation or appreciation of the rupee.

A “crawl-like arrangement”, as per the IMF’s definition, implies an exchange rate regime that is neither fully floating (i.e. market-determined) nor pegged at near-fixed levels relative to other currencies (“stabilised”). A “crawling” peg allows the currency’s value to be adjusted gradually within a 2% band around a statistical trend for six months or more.

Story continues below this ad

Whatever be the classification, it’s clear that the RBI under the present governor Sanjay Malhotra (he assumed office on December 11, 2024) has adopted a more flexible exchange policy with only occasional interventions through dollar purchases and sales.

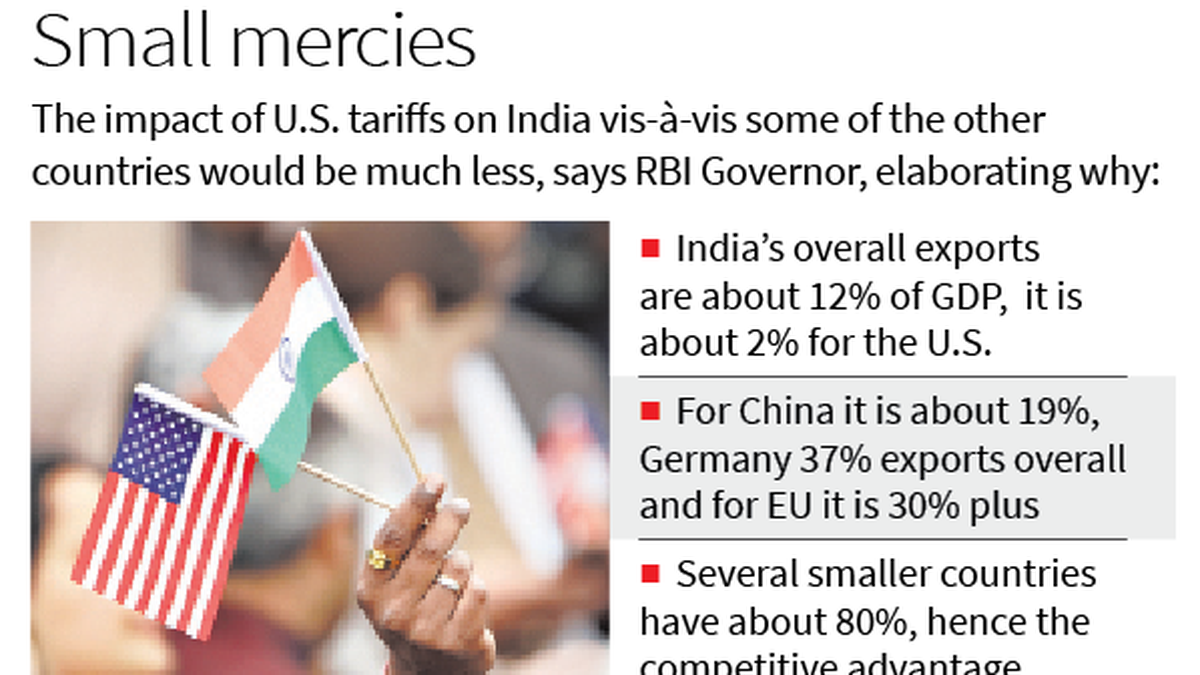

The changed approach has been influenced partly by easing domestic inflation (reducing the need for a strong rupee to keep import costs artificially low) and also the imperative to maintain India’s trade competitiveness (especially following the US President Donald Trump’s unilateral tariff actions and increased threat from China redirecting its exports to the rest of the world).

If the current nominal depreciation (the domestic currency shed 73 paise against the dollar in November) and relatively low CPI inflation is sustained, the coming months could see a further decline in the rupee’s REER.