Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD/JPY drives losses in Asia

The US dollar collapsed across Asia on Monday as markets were hit by a massive sell-off that saw the Japanese Nikkei suffer its worst one-day loss since “Black Monday” in 1987.

Global markets remained pressured overnight with the US’s S&P500 down 2.6% and the tech-focused Nasdaq down 3.4%.

In FX markets, the USD/JPY led the losses, with the risk-sensitive carry trade, in which traders borrow in the low-interest rate JPY and buy US dollars, turning sharply lower as participants rushed for the exits.

The USD/JPY fell 1.7% on Monday and is now down 11% from last month’s 38-year highs.

The USD’s losses across Asia saw the USD/SGD fall 0.2% as it fell to the lowest level since January.

The USD/CNH was also sharply lower, down 0.4%. as it briefly touched 15-month lows.

Euro, GBP outperform

The move in USD/JPY explains why the US dollar isn’t displaying the kind of safe-haven appeal often seen when sharemarkets sell-off. Traditionally, as sharemarkets fall, the US dollar often climbs as investors look for safety in the US dollar.

Instead, the US dollar has been mostly weaker, with the USD index at six-month lows overnight.

The euro has been one of the stronger currencies with the GBP also higher, but the British pound might be tested ahead of today’s BRC retail sales numbers.

In the UK, all retail sales figures for June were disappointing. Both the BRC and CBI surveys softened, and some of May’s rise was retracted from the official figures.

The July CBI survey has already been released, and it further undermined the headline balance as well as the indicator of sales volumes for the season. While rising interest rates should work against the growth of consumer spending, rising confidence and real pay are supportive of it.

The GBP/USD sees support around 1.2700 and a break below here sets up a broader reversal.

Aussie awaits RBA rate decision

The Australian dollar saw a volatile session, with the AUD/USD hitting the lowest level for 2024 before rebounding to end near flat for the day. The Aussie weakened in Asia with the AUD/CNH down 0.5% and the AUD/JPY down 1.9%.

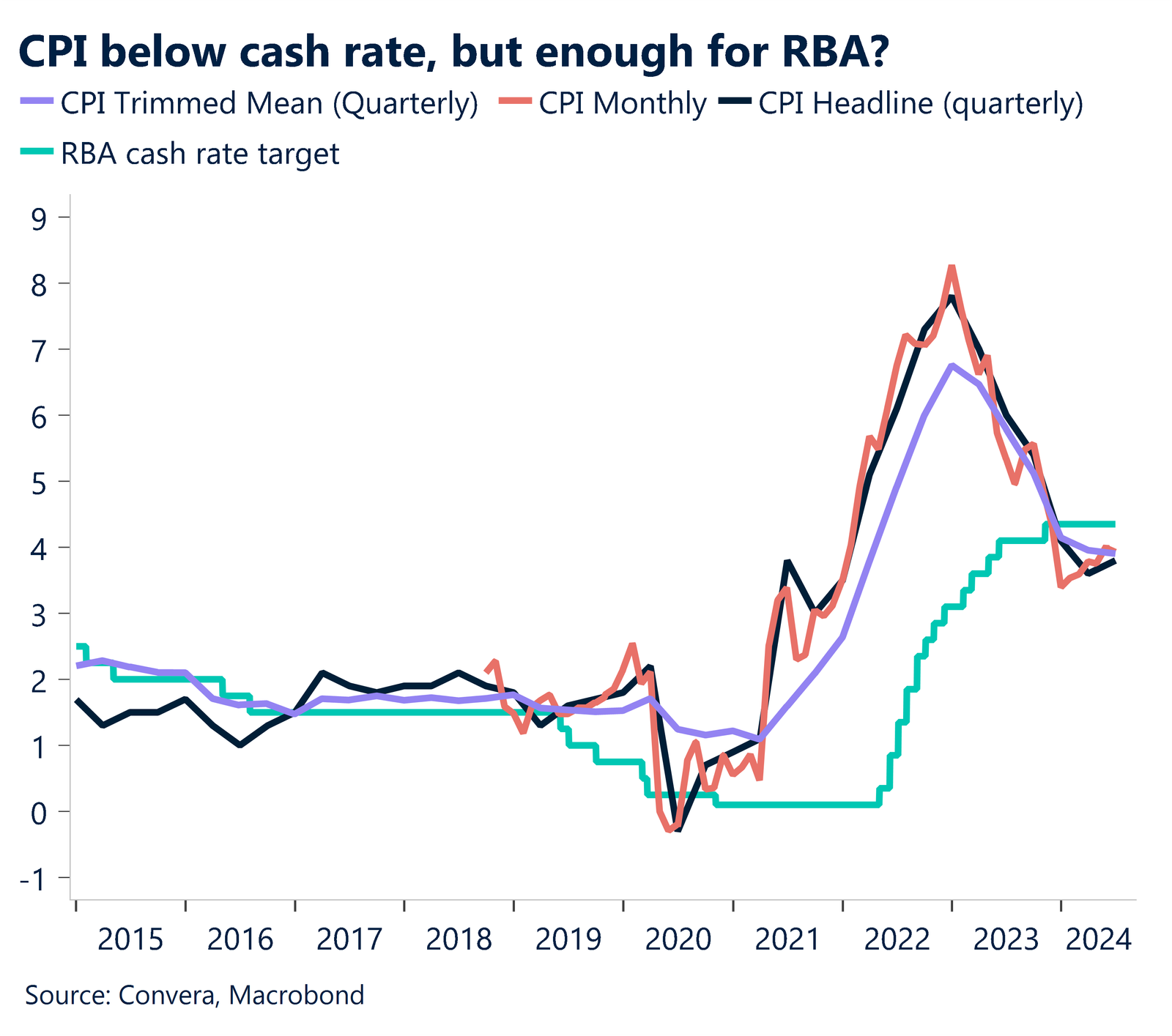

Looking forward, all eyes are on the Reserve Bank of Australia, which seems likely to once more declare a cash rate of 4.35%.

This view is supported by the fact that Q2 CPI inflation was in line with RBA forecasts, rising 0.7% q-o-q for non-tradeables and 1.0% q-o-q for headline CPI and 0.8% q-o-q for trimmed mean CPI. Still, inflation did not fall short of the RBA’s forecast, nor did it rise.

Furthermore, we believe it will stop well short of declaring victory given that inflation stays above the target band, unemployment is below NAIRU, and the US and Australian CPI inflation rates have been fluctuating this year.

Instead, we anticipate the RBA will restate that getting inflation back to target is still the top priority, that it is still above target, and that the outlook is still uncertain. Thus, we anticipate cautious policy recommendations that offer the greatest amount of flexibility.

USD/SGD, USD/CNY at multi-month lows

Table: seven-day rolling currency trends and trading ranges

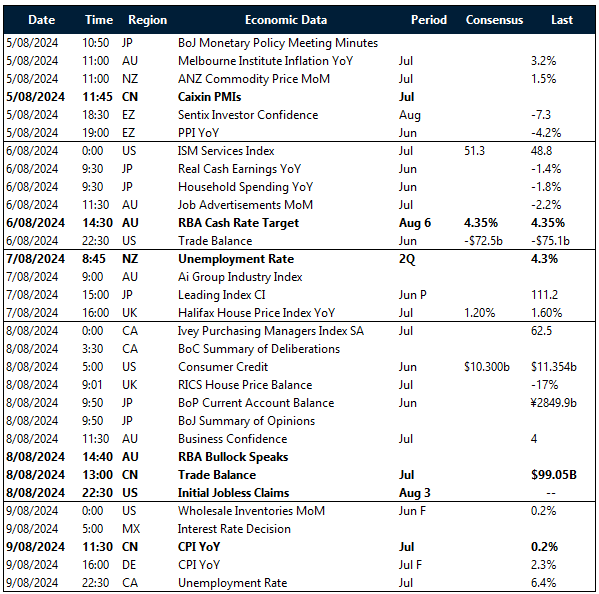

Key global risk events

Calendar: 5 – 9 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]