Beyond the economic implications, the fall has directly impacted individuals as well. Foreign institutional investors (FIIs) have been continuously withdrawing funds from the Indian equity markets, and Indian investors’ domestic portfolios have come under pressure due to the volatility.

Likewise, outbound travellers are feeling the heat. Last-minute travel plans are likely to be 10-15% costlier purely due to the rupee depreciation, but even those who made bookings in advance may have to watch their discretionary spending.

Overseas students, as well as their parents, are in the most unenviable position, unless they have planned ahead to cover currency fluctuations by investing in dollar-denominated avenues. ET Wealth examines the repercussions of rupee depreciation and strategies to mitigate the impact.

Students, parents must plan

The overseas education space, especially the US market, was already in a flux, with the geopolitical shifts and significant changes to the visa policies taking their toll on Indian students and parents. “The uncertainty has prompted many students to defer decisions, particularly to the US, which remains the largest education market globally with over 4,000 universities,” says Eela Dubey, Co-founder, Edufund, an education financing platform.

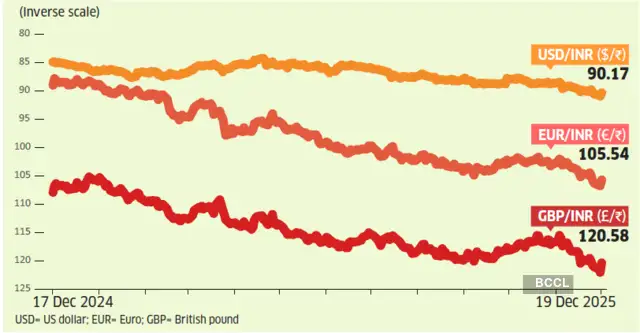

According to education counselling firm Collegify’s Co-founder Rohan Ganeriwala, the rupee’s recent depreciation has introduced a degree of uncertainty to budget-conscious students and families. “The rupee has moved from around Rs.87 per dollar in September to about Rs.91 now, and while currency cycles are not unusual, the short-term volatility may require families to reassess their planning. Many students have already taken education loans, and with a combination of rising tuition, forex charges, and currency fluctuations, overall costs can deviate from original estimates,” he says.

Ganeriwala adds that parents are stepping in to bridge the near-term gaps, often through careful budgeting or phased funding. “For students on scholarships, universities are generally open to reviewing requests for additional support on a case-by-case basis. At the same time, students are increasingly looking at on-campus employment and other opportunities to manage expenses.”

In the long-term, thoughtful planning to hedge currency risk is the only solution. “One way to do this is by investing in dollardenominated or overseas assets, rather than remaining entirely rupee-centric. Access to international investments has improved in recent years. For instance, parents can now use the GIFT City route to invest in outbound retail mutual funds or international stocks,” says Dubey.

Invest outside India for stability

The weakening of the rupee has brought currency risk and global diversification back into focus for Indian investors looking overseas. While a falling rupee can boost returns from foreign assets, experts caution that currency movements should not become the primary driver of investment decisions.

“A weaker rupee can benefit investors when overseas profits are eventually repatriated to India, but it is not an unqualified positive,” says Kunal Valia, Founder and Compliance Officer, StatLane. He points out that India is a net importer, and abrupt currency depreciation raises import costs, widens trade and current account deficits, and hurts the broader economy. According to Valia, the recent move has been “ad hoc rather than gradual,” driven by the Reserve Bank of India’s (RBI) limited intervention, sustained FII outflows and uncertainty around a US-India trade deal.

That said, Valia believes global investing should be pursued regardless of currency levels. “Currency should be the least of the worries for investors when investing overseas,” he says, adding that global markets offer exposure to sectors such as semiconductors, advanced manufacturing, biosciences and artificial intelligence (AI) that are not meaningfully available in India. Short-term swings, from Rs.87 to Rs.91 or vice versa, are largely irrelevant for long-term investors who cannot predict when they will book profits or repatriate capital.

From a return perspective, a weaker rupee can structurally work in investors’ favour over time.

“A depreciating rupee improves rupeeadjusted returns of overseas investments by providing a currency uplift,” says Pavan Kavad, Managing Director, Prithvi Exchange (India). However, he cautions that currency is “both a tailwind and a risk,” enhancing long-term returns while adding short-term volatility.

Kavad advises investors against trying to time currency moves. “A disciplined, phased approach aligned with asset allocation is far more effective than reacting to short-term rupee fluctuations,” he says. For most retail investors, he suggests a 10-25% overseas allocation, adding that overseas investing also acts as a natural hedge against long-term rupee depreciation, as long as exposure remains proportionate to rupee-based income and liabilities.

₹ slips below 90

A weakening rupee is forcing households to rethink overseas spending, education funding and diversification strategies.

Globe-trotters’ budgets to be hit

Overseas-bound travellers who are planning to book their flight tickets and hotels now will have to brace up for 10-15% increase in costs. “The weaker rupee directly impacts airfares, visas, overseas hotel rates and on-ground spends. As a result, we are seeing travellers either shortening their trips, or opting for closer-haul destinations, or bundled packages to manage budgets,” says Karan Agarwal, Director, Cox & Kings.

Travellers whose international holidays were planned two to three months ago, and the rates had been locked, might have to sweat less, though discretionary spends such as shopping, dining and local transport could still be costlier. Spending discipline, therefore, will be the key. “Using prepaid forex cards instead of international credit cards, avoiding dynamic currency conversion at point-of-sale, and planning daily spends in advance can meaningfully reduce overshooting budgets. Experiences booked upfront tend to cost less than on-the-spot purchases,” says Agarwal.

Forex cards can help travellers who plan ahead lock-in their rates, but do not score high on rewards points, cashback offers or linked hotel loyalty programmes that credit cards offer. “When chosen well, credit cards can reduce the overall outgo of even lastminute planners. For example, points under certain hotel-linked loyalty programmes can be converted at a fixed rate: so, 2,000 points could be worth, say, 40 euros. Earlier, 40 euros may have been worth Rs.4,000-Rs.4,100; today it could be closer to Rs.4,300 (due to weaker rupee), effectively increasing the value of points already earned,” explains Kashif Ansari, Professor, OP Jindal University and a credit card expert.

If you hold premium credit cards, they can amplify such benefits. “For example, certain cards offer two reward points on every foreign currency transaction, which can be converted into, say, eight hotel loyalty points. Even after accounting for a foreign exchange mark-up of around 2.8-3%, users can still extract double-digit effective value, enough in some cases to offset hotel costs entirely,” he adds.

If you have had to book holidays at the last minute, make efforts to identify the right mix of spending tools that you can use to reduce the total travel expenses.