Pound Sterling closed firmer at the end of last week, with GBP/EUR near 1.1500 and GBP/USD around 1.3650 as markets look ahead to next week’s UK inflation release.

Pound to Euro (GBP/EUR): 1.15049

Pound to Dollar (GBP/USD): 1.36551

Euro to Dollar (EUR/USD): 1.18689

UK economists at Pantheon Macroeconomics expect January CPI inflation to ease to 3.0% from 3.4% in December, reflecting slower energy, food and education price growth alongside a sharp seasonal drop in airfares.

The analysts trimmed their previous 3.1% call after factoring in more aggressive January discounting from pub chains, though it still expects inflation to come in slightly above the Bank of England’s 2.9% forecast.

Pantheon argues that services inflation remains sticky, highlighting firm hotel pricing and survey evidence suggesting little easing in underlying cost pressures at the start of 2026.

It also flags potential upside risks from medical services and insurance pricing.

If inflation prints at or above 3.0%, particularly with firm services components, sterling could see modest support as markets reassess the pace of Bank of England rate cuts.

A softer surprise closer to the MPC’s forecast, however, may reinforce expectations of easing later this year and leave GBP/EUR and GBP/USD vulnerable to renewed pressure.

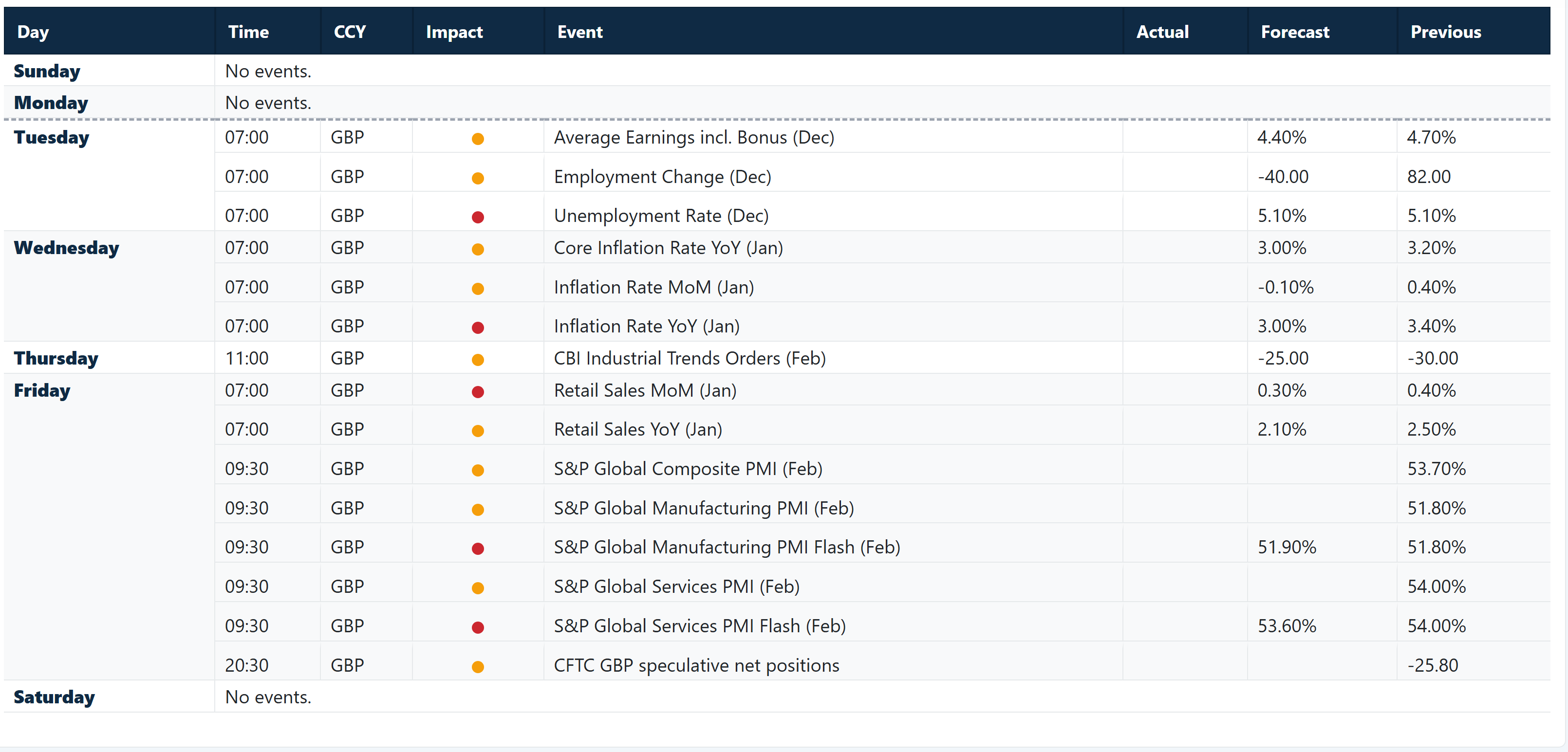

GBP Events to Watch Next Week

Sterling’s focus turns quickly to hard data after a quiet start.

Tuesday’s labour report is expected to show slower wage growth and a drop in employment, which could reinforce expectations of Bank of England easing if confirmed.

However, unemployment is seen steady at 5.1%, limiting the signal.

Wednesday’s CPI release is the key event, with both headline and core inflation forecast to cool. A softer print would likely weigh on the pound, particularly against the dollar, while any upside surprise could prompt a short squeeze.

Friday’s retail sales and flash PMIs will test whether growth momentum is holding up.

Weak consumption and softer activity surveys would leave Sterling vulnerable, whereas resilient readings could help it consolidate near recent ranges.