The internationalisation of the renminbi has been held back by the Chinese government’s aversion to risk, says an economist, which undercuts efforts to further expand the currency’s use beyond the country’s borders despite ambitions to establish it as a global reserve currency.

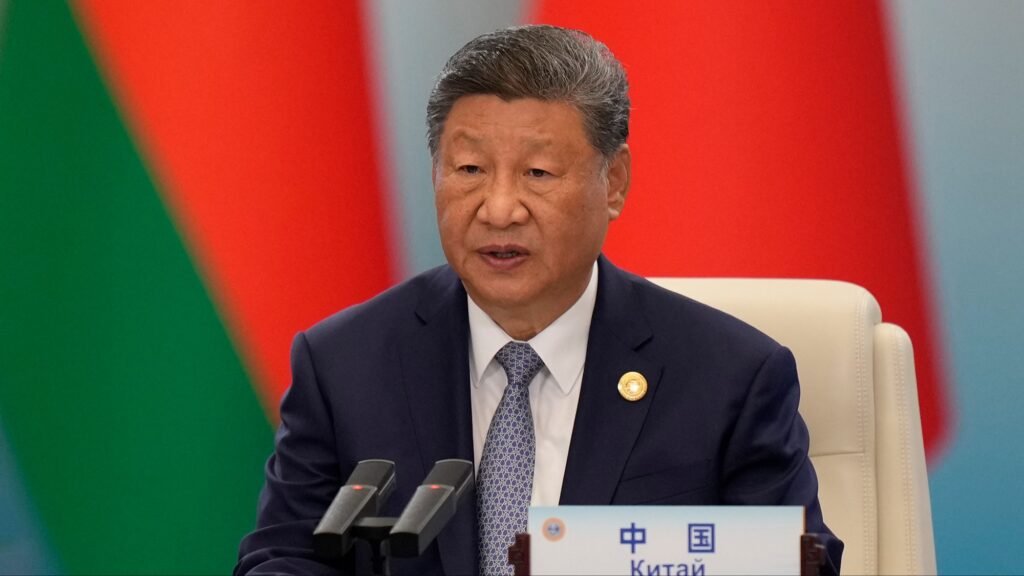

Chinese President Xi Jinping on Saturday called for the renminbi to attain global reserve currency status, saying that the country needed to build a “powerful currency” that could be “widely used in international trade, investment and foreign exchange markets, and attain reserve currency status”, the FT reported.

As the world’s largest exporter and second biggest economy after the US, China has made efforts to increase the usage of its currency in international transactions, challenging the dominance of the US dollar. Yet such efforts, which began in earnest following the global financial crisis of 2008, have failed to dislodge the greenback as either the reserve currency of choice or the primary instrument of global trade.

“The government has been talking for years about the internationalisation of the renminbi, but the slow progress reflects their risk averse mentality,” said Chen Zhao, chief global strategist of Oxford Economics-owned investment research company Alpine Macro.

“[They are] concerned about internationalising too quickly, and causing a debt crisis through the loss of capital controls. They have a siege mentality,” he added.

While the renminbi was the fourth-most popular global payment currency in the world for much of 2024, its market share has never risen above 4.8 per cent, according to Swift data. The currency was the sixth-most used currency in December 2025, with growth in renminbi payments that month lagging that of other currencies. The currency is a distant second to the dollar within the trade finance market.

Hong Kong dominates the offshore use of the renminbi, with 74.6 per cent of transactions in November 2025 originating there. The UK places a distant second, seeing 7 per cent of transactions.

At the end of last year, the government made clear signals it was intending to push further international renminbi use. During a meeting of the People’s Bank of China in October 2025, governor Pan Gongsheng said the central bank would “promote the yuan’s internationalisation, boost its use in trade, further open up financial markets in a gradual and orderly way, and support the growth of offshore yuan markets”.

Zhao told The Banker the renminbi’s lack of convertibility, which determines how easy it is for a currency to be exchanged for other foreign currencies, is having a significant impact.

“The renminbi will not dominate as a currency for trade settlement as the currency is not convertible,” he said. “Once the currency is fully convertible, it will make the proposition more interesting.”