China’s central bank set the strongest guidance rate for the yuan in almost three years, suggesting it will allow its currency to gradually appreciate even while trying to avoid hurting exporters.

The People’s Bank of China set its so-called fixing for the Chinese currency at 6.9929 against the U.S. dollar on Friday, compared with 7.0019 in the previous session. This marks the first time the reference rate has been set stronger than 7 yuan against the dollar since May 2023.

The 7 yuan mark is closely watched as it is considered a signal of Beijing’s tolerance toward currency appreciation as calls for a stronger yuan grow both at home and abroad amid a ballooning Chinese trade surplus.

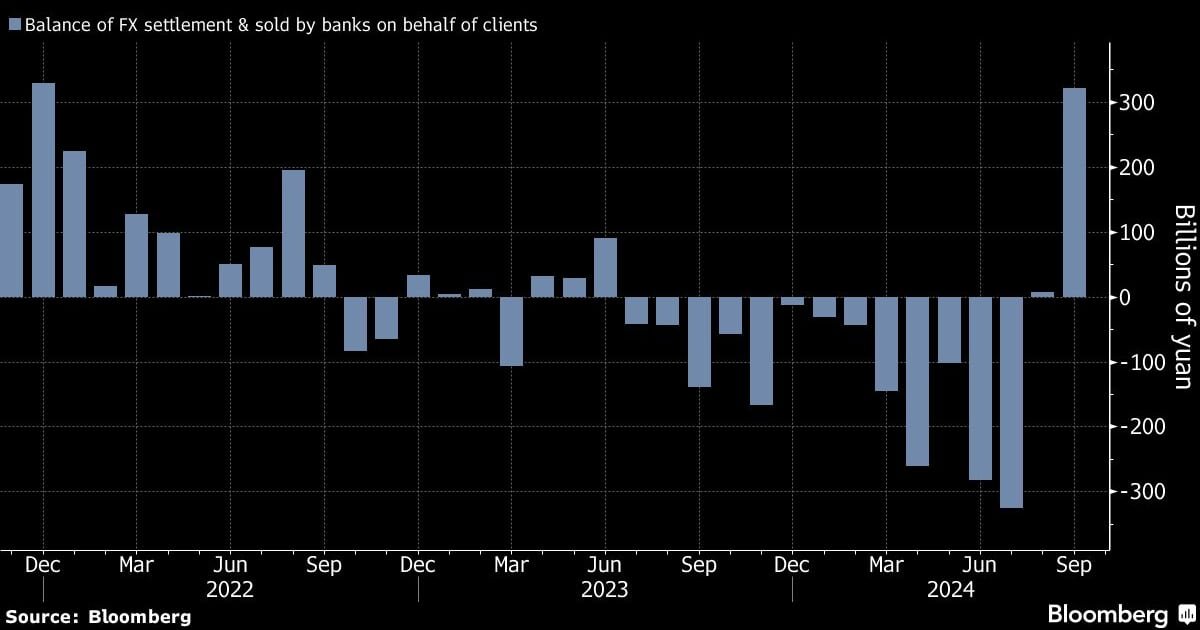

Despite the Trump administration’s efforts to blunt Chinese exports’ global dominance, China’s annual trade surplus surpassed $1 trillion for the first time last year, a milestone that many economists say is partially the result of a real depreciation of the yuan due to China’s low inflation relative to its trading partners.

Robust exports did heavy lifting for the world’s second-largest economy to grow 5.0% last year. Still, consumer prices stayed flat as a yearslong property slump continued to weigh on household spending.

While the yuan has been strengthening against the greenback over the past year, calculations from Goldman Sachs last month suggest it remained 25% undervalued relative to China’s economic fundamentals. Gavekal Dragonomics also noted in December that the yuan’s real effective exchange rate–adjusted for price levels–was down about 15% from its 2022 high.

Analysts suggested that the PBOC’s recent firm fixings for the yuan reflect Beijing’s growing comfort with a modestly stronger currency, bolstered by a weakening dollar, surging exports and a rallying domestic stock market. However, they added that a rapid strengthening for the yuan, also known as the renminbi, remains unlikely as authorities have consistently signaled restraint by setting recent fixings at weaker levels than market expectations.

“Now the key question is how much renminbi appreciation the PBOC is willing to permit, given concerns about monetary tightening, unemployment, deflation, and export competitiveness,” said Gabriel Wildau, managing director at Teneo, in a recent note.

Wildau said Beijing’s tolerance for a stronger yuan is likely motivated by goodwill toward trading partners, efforts to boost confidence among investors and businesses, as well as improving confidence in the economic outlook that implies a lessened need to boost exports through currency weakness.

The yuan was recently trading at 6.9627 to the dollar in onshore markets and 6.9585 offshore, LSEG data showed.

Write to Singapore Editors at singaporeeditors@dowjones.com

(END) Dow Jones Newswires

January 22, 2026 23:37 ET (04:37 GMT)

Copyright (c) 2026 Dow Jones & Company, Inc.