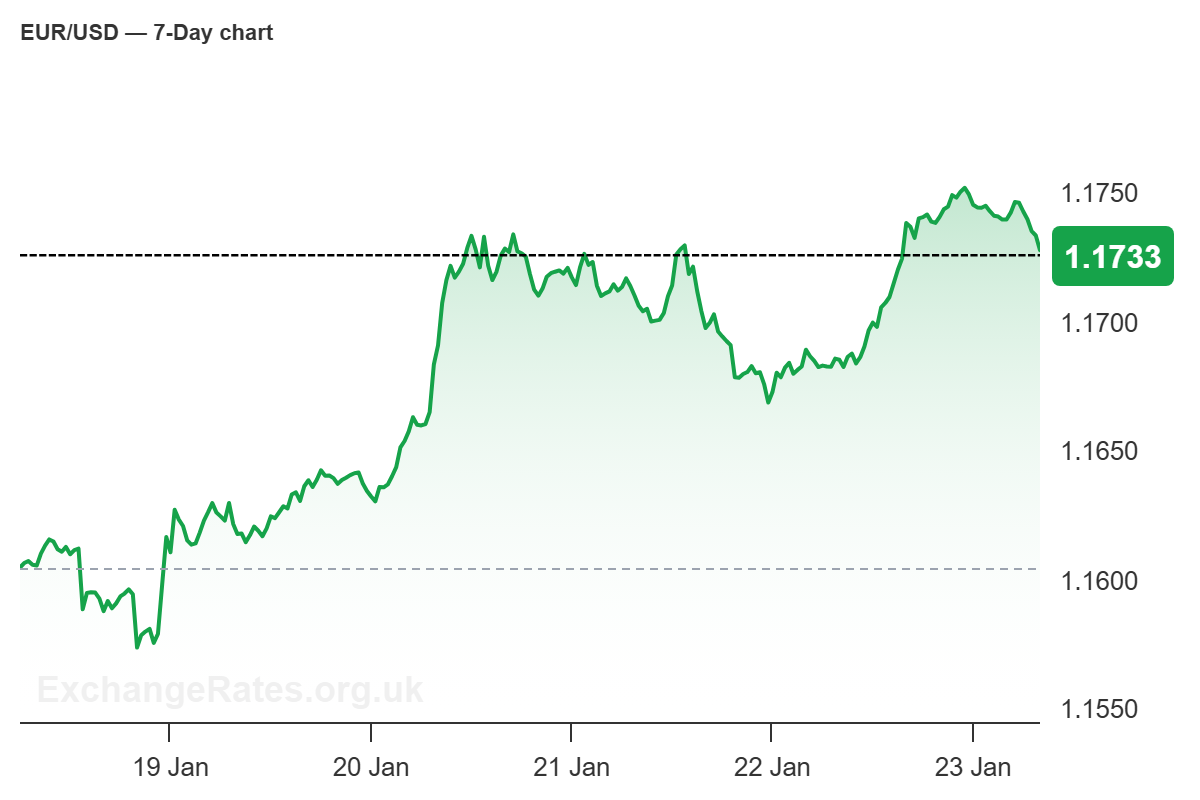

The Euro to US Dollar exchange rate (EUR/USD) is trading at 1.1732, slightly lower on the day but still near the upper end of its recent range after a volatile January.

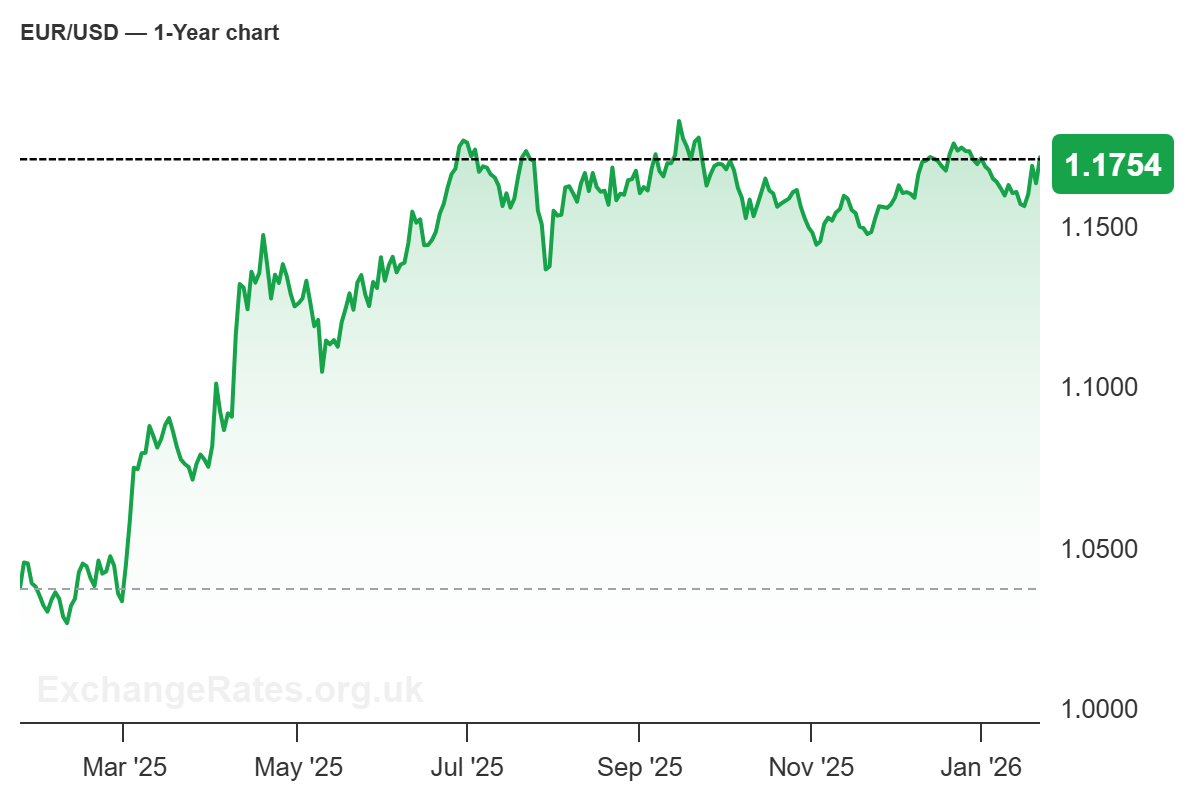

EUR/USD has traded within a relatively tight 1.15–1.19 corridor over recent months, as supportive and offsetting forces on both sides of the Atlantic have largely cancelled each other out.

From the Exchange Rates UK Research team’s perspective, the resilience above the mid-1.16 area suggests the broader uptrend from early 2025 remains intact, even as momentum has slowed near recent highs.

Range trading masks building pressure on the U.S. Dollar (USD)

Strategists at UBS argue that the recent period of consolidation reflects a market waiting for the next leg of US dollar weakness rather than a meaningful reversal in favour of the greenback.

“Several diverging factors kept EUR/USD in a stable range over recent months,” UBS notes, adding that it continues to expect “another round of USD weakness to push the pair to 1.20 in the first half of 2026.”

US macro data remain mixed. Strong GDP growth and resilient consumer spending point to underlying economic strength, but a softer labour market and subdued inflation reinforce expectations that the Federal Reserve will continue cutting rates to move policy from restrictive towards neutral.

In UBS’s view, this policy backdrop should keep US yields drifting lower over the coming months, weighing on the dollar.

Euro (EUR) support hinges on fiscal impulse

In the euro area, sentiment indicators have held up well, though UBS cautions that firmer “hard” economic data will be needed to sustain further euro gains.

The bank expects this improvement to emerge gradually as fiscal stimulus filters through the economy later in 2026, supporting its constructive stance on the single currency.

UBS maintains an Attractive view on the euro, alongside currencies such as the Australian and Norwegian kroner, while keeping the US dollar rated Unattractive.

In a world of easing volatility and declining yield differentials, the bank favours selective long positions in higher-yielding currencies over traditional low-yielders.

Political risks skew against the dollar

Beyond macro fundamentals, UBS highlights US political developments as an ongoing source of uncertainty for the dollar.

While major trade war risks appear to have faded, issues ranging from Venezuela and Greenland to concerns over Federal Reserve independence continue to inject volatility into USD pricing.

The nomination of a new Fed Chair, legal scrutiny involving senior policymakers and an upcoming Supreme Court decision on US tariffs are all seen as downside risks for the dollar at the margin.

UBS argues that, taken together, these factors leave political risks “skewed toward USD weakness.”

EUR/USD Near-Term Outlook 1.20 in sight

From a longer-term perspective, EUR/USD has already risen sharply from near parity in 2024 to around 1.17, meaning a significant portion of the re-rating is already behind us.

UBS nonetheless expects the pair to extend gains towards 1.20 in the coming months, driven by renewed dollar softness rather than a dramatic acceleration in euro strength.

For now, we think the balance of risks for the euro to dollar (EUR/USD) exchange rate remains tilted to the upside.

While gains may become harder to sustain as EUR/USD approaches the 1.20 area, UBS’s outlook suggests the path of least resistance still points higher in the first half of 2026, particularly in a pro-carry, lower-volatility environment.