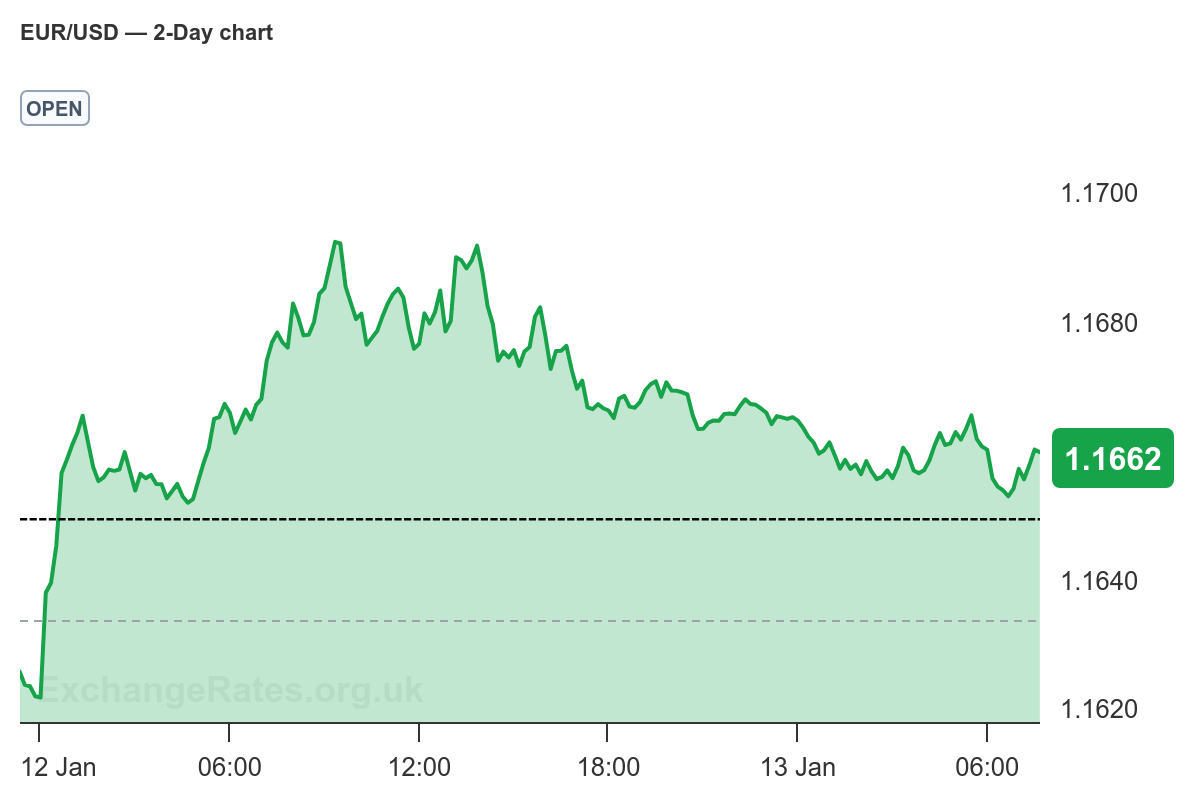

The US dollar exchange rate complex is softening modestly against major peers, with the pound to dollar (GBP/USD) trading at 1.3446 (-0.15%) and the euro to dollar (EUR/USD) at 1.1653 (-0.12%), as investors reassess the durability of US exceptionalism into 2026.

Lloyds Bank argues the broader backdrop remains unfavourable for the dollar, not because of any single shock, but due to the cumulative impact of US political intervention, slowing labour-market momentum and rising doubts over the dollar’s long-term safe-haven status.

From Lloyds’ perspective, growing pressure on the Federal Reserve, including legal and political challenges to its independence, reinforces existing structural negatives for the currency rather than creating a new regime shift. While markets have so far reacted calmly, the bank suggests this reflects familiarity with political noise rather than genuine comfort with the underlying trajectory.

The US economy itself is described as increasingly unbalanced. Employment growth is close to stall speed outside a narrow set of AI-linked sectors, while broader investment remains weak. Lloyds argues this two-speed dynamic limits the scope for sustained dollar strength even if headline growth remains near 2%.

Although the Fed has already delivered three rate cuts, Lloyds believes market pricing still understates the risk of further easing as political pressure intensifies and labour-market slack builds. In that environment, the dollar’s yield advantage is likely to erode rather than widen.

Crucially, Lloyds frames the dollar outlook in relative terms. As fiscal expansion and policy visibility improve elsewhere, particularly in the Eurozone and Japan, portfolio diversification away from the US is expected to continue, reinforcing a gradual downtrend in the greenback.

Overall, Lloyds remains bearish on the US dollar, favouring exposure to the euro, Swiss franc, Norwegian krone, Australian dollar and renminbi, and sees the current phase as part of a broader, self-reinforcing shift toward weaker USD performance through 2026.