The US Dollar-to-Canadian Dollar exchange rate (USD/CAD) is seen as losing momentum as Canadian data comes back into focus

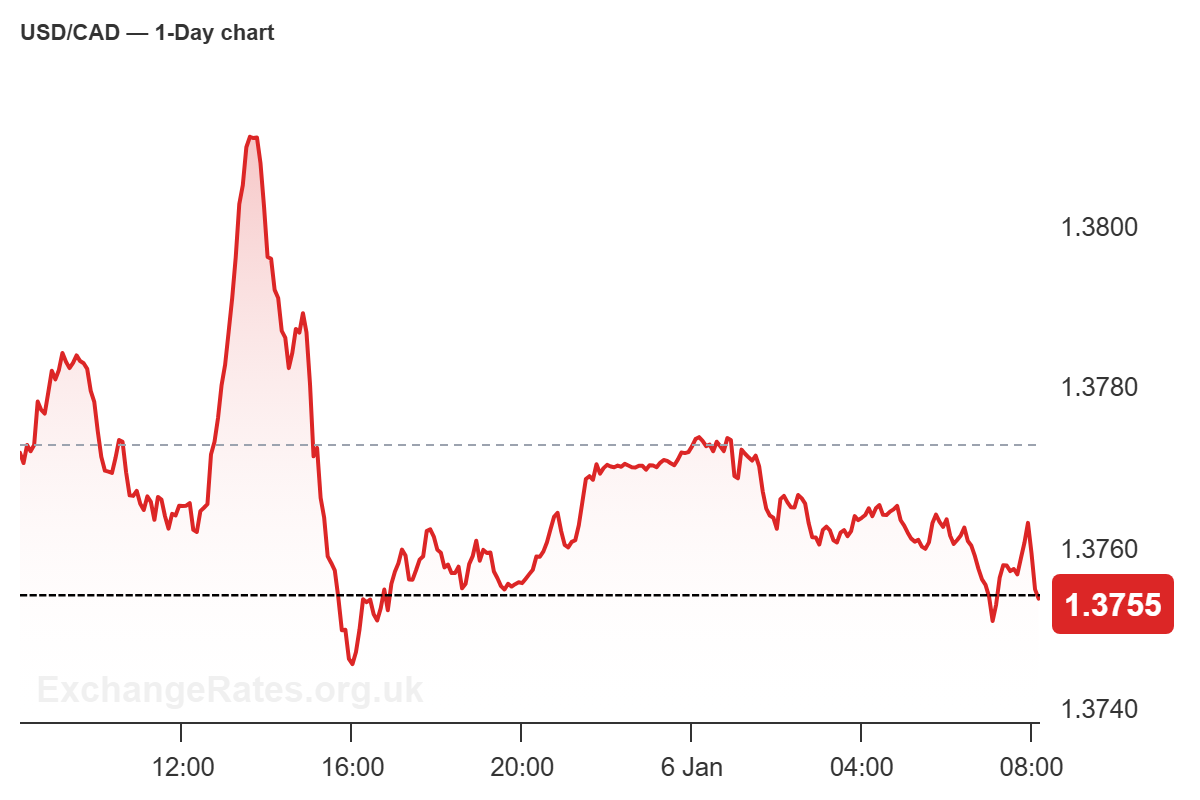

The US Dollar is currently trading near 1.3765 against the Canadian Dollar, with recent moves largely mirroring the broader direction of the US currency through the holiday period.

Scotiabank FX analysts say the lack of Canada-specific news has left the Loonie taking its cue from USD trends, though that dynamic may soon shift as domestic data flow resumes.

Pound to Canadian Dollar (GBP/CAD): 1.86585 (+0.1%)

Euro to Canadian Dollar (EUR/CAD): 1.61433 (+0.05%)

Dollar to Canadian Dollar (USD/CAD): 1.37578 (-0.12%)

The bank notes that Canadian releases are set to pick up over the coming days, including PMI updates, trade figures and Friday’s employment report.

Scotiabank analysts argue that the Canadian dollar ended last year on a firmer footing after a run of better-than-expected data, and could regain ground if incoming numbers continue to show relative resilience compared with the US.

From a technical perspective, Scotiabank sees the short-term setup as neutral to mildly bearish for USD/CAD.

Recent price action suggests the dollar’s rebound from late-December lows may be losing steam, with intraday patterns hinting at hesitation rather than a clean extension higher.

The bank highlights 1.3810 as a key level that would need to break to revive upside momentum, while support sits near 1.3750 and 1.3725.

Scotiabank sees scope for the USD/CAD exchange rate to drift lower in the near term outlook if Canadian data reassert themselves and the broader US dollar rally continues to fade.