Join Our Telegram channel to stay up to date on breaking news coverage

XTB recently announced that its users can now earn up to 4.25% on their idle GBP balances. This is a major milestone among regulated UK brokers, as users can earn passive income by simply holding their assets in XTB, without any minimum requirements or strings attached.

The XTB cash yield applies to new and existing clients, regardless of their account size. If you don’t have an account yet, sign up on XTB to enjoy this feature while you consider your next investment.

A Closer Look at XTB’s 4.25% Interest on GBP

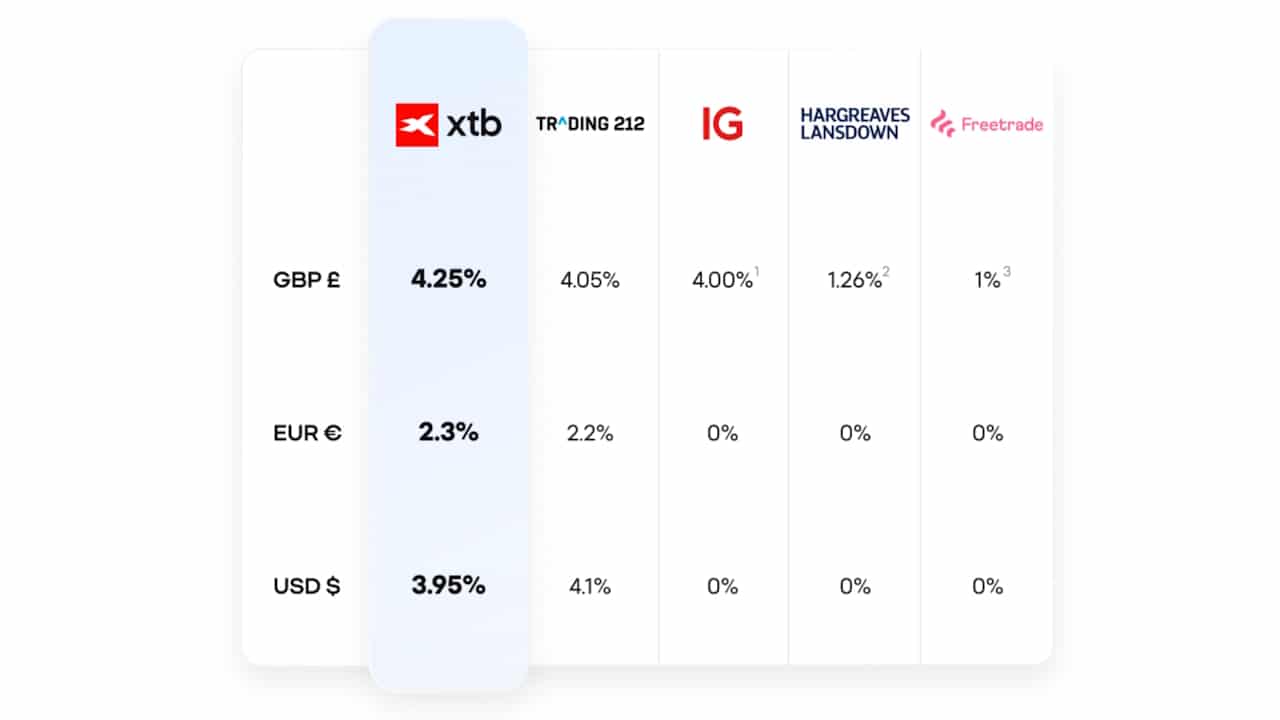

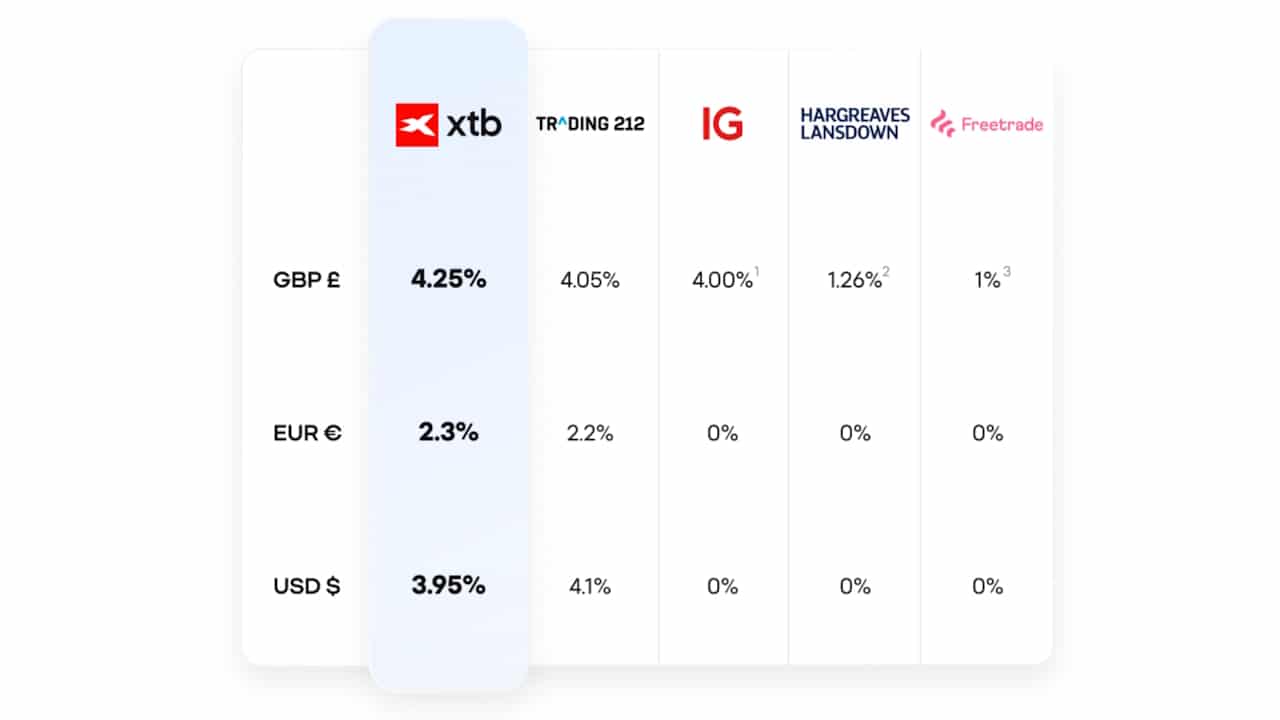

XTB offers generous yields on uninvested balances, which apply to three currencies with varying annual yields:

- GBP balances get 4.25%

- USD balances get 3.95%

- EUR balances get a 2.30%

These balances are calculated daily (at 23.00 GMT) and paid out monthly. Users don’t need to do anything; crediting interest yields is automatic within the first five days of the month.

The best thing about this feature is that users of all account sizes are eligible to earn interest. There are no minimum or maximum amount requirements, and XTB doesn’t require its users to reach a trade threshold or maintain positions.

Steady Returns Without Hassle

Earning interest on uninvested funds is a valuable feature that benefits investors who keep their funds on XTB while waiting for the right market opportunity to appear. That way, your capital efficiency is maximized, and you don’t have to worry about inflation eating away at your funds or missing out on the next big asset.

This rate only applies to the funds that are uninvested. For example, if you hold £15,000 in your account, you will earn £637.5 per year with the current rate of 4.25%. With inflation in the UK averaging around 3.2%, holding your funds on XTB could easily offset it.

Keep in mind, the rate for EUR and USD differs from the GBP rate. For example, holding $15,000 USD in your account will accrue $592.5 for the same period with the rate of 3.95%.

XTB Leads the Market with the Best Cash Yields of 2025

XTB offers a 4.25% AER (Annual Equivalent Rate) on GBP funds, which is higher than most of its competitors. Moreover, earning cash yield on XTB is automatic and has no special requirements aside from keeping the funds idle.

For comparison, IG offers a similar rate of up to 4.25% on GBP, but it’s limited to £100K, and it requires that you have an open position or make monthly trades to be eligible for the yield.

Hargreaves Lansdown, on the other hand, offers a much lower rate of 1.26% on up to £9,999.99 and 1.56% on balances over £100K, which can’t really compete with XTB’s offer.

Freetrade’s Basic account gets 1% interest on idle yields up to £1,000, while Plus accounts get 5% limited to £3,000, but it also requires a monthly payment of £9.99.

Considering all factors, XTB is unmatched with its current cash yield on uninvested balances for UK investors.

Accrue Interest Daily, Get Paid Monthly

The XTB cash yield is the best in the industry, and it’s easy to claim it. Every day, your interest is calculated, and within the first five days of the following month, your interest will be credited to your account.

Note, the interest rate can change at any moment. However, XTB publicly discloses this rate on its website, where users can track historical rates to know if they’re getting a better deal than the one before.

While earning interest is important, it’s even more important to know how safe your funds are. XTB is an FCA-regulated broker, meaning it has to safeguard user funds under regulatory standards. User funds are held in segregated bank accounts, and whatever happens to XTB or its funds, user funds can’t be touched.

Value for Every Investor

Earning cash yield on balances that are yet to be deployed is valuable for every investor. For example, active traders can earn interest on free funds between trades, which means they are still earning at a rate of 4.25% on GBP annually even if their funds aren’t invested.

Long-term investors who wait for months before deploying their capital get to offset annual inflation and make something on top without extra effort.

Diversified investors also benefit, as they earn interest on multi-currency holdings without having to move their cash between accounts.

Safety Through FCA Regulation

XTB is fully regulated by the FCA (you can look up the filing under the reference number 522157). As a regulated company, XTB must keep client funds in segregated bank accounts, which are also protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person in the event of XTB’s insolvency.

This should give every investor peace of mind that their funds are safe while accruing interest. In addition to regulated protections, XTB uses security measures, like multi-factor authentication with SMS or authenticator apps, encrypted connections, and more.

Under HM Revenue & Customs (HMRC) rules, interest earned that exceeds a certain level of income is exempt from paying tax in the UK. However, seek independent advice to ensure whether you have to pay tax on your interest yields.

Grow Your Idle Cash With XTB

XTB’s cash yield of up to 4.25% on idle GBP funds is one of the highest yields you can currently get. New and existing users are eligible to earn this rate, while no minimum or maximum requirements apply.

Join over 1.7 million clients earning interest on their uninvested funds. Visit XTB.com to learn more.

Join Our Telegram channel to stay up to date on breaking news coverage