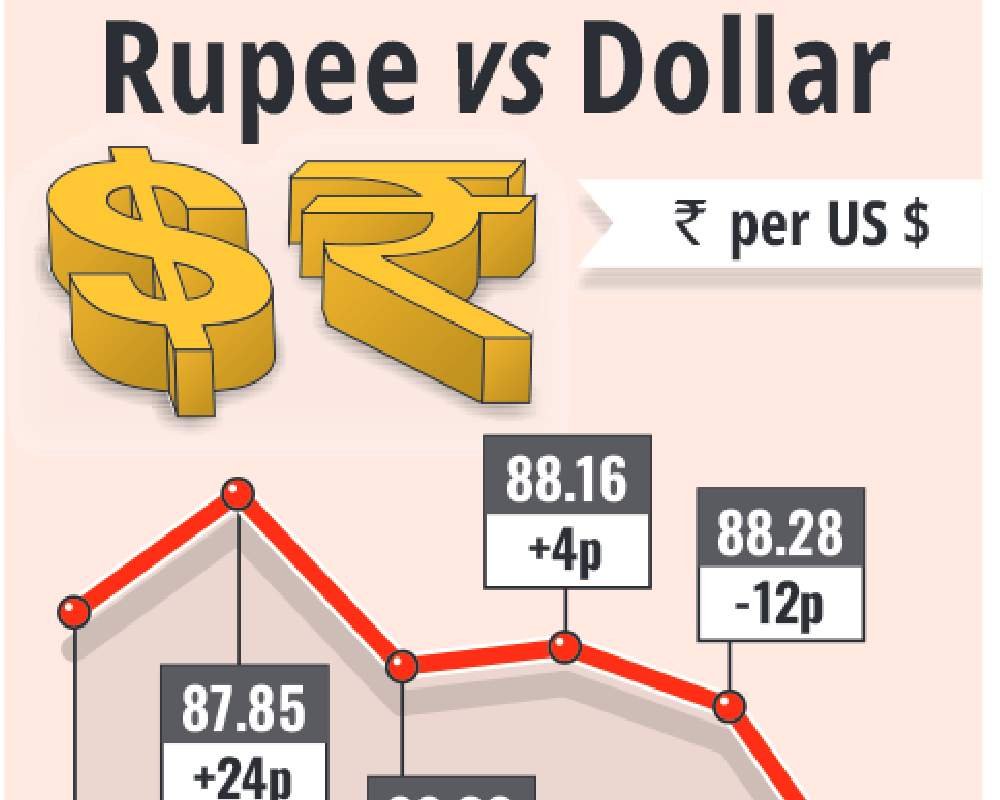

Mumbai: The Indian rupee staged a remarkable comeback on Wednesday rebounding nearly 75 paise from its record lows to close around 88.06 against the US dollar as the central bank stepped in with decisive measures to counter what it described as speculative attacks on the currency.The RBI was alarmed to see the rupee nearing the 89 a dollar level during the trading sessions and aggressively sold dollars in both onshore and offshore markets through state run banks after what it saw as speculative attacks by global fund managers on the rupee, said a report. Traders said that this intervention highlighted that the RBI is keen on defending the 88.80 levels. The other factors that supported the rupee was a weak dollar, optimism over US-India trade negotiations and overnight decline in crude oil prices. At the interbank foreign exchange, the rupee opened at 88.74 against the greenback, and fell below the 88-mark during the session, touching a high of 87.93 per dollar. The domestic unit finally settled at 88.06 against the greenback, registering a rise of 75 paise over its previous close, its biggest intraday gain in nearly four months. On Tuesday, the rupee had depreciated by 13 paise to close at an all-time low of 88.81 against the US dollar.

Says Abhishek Goenka, founder and chief executive officer of IFA Global, “Today’s sharp recovery was also underpinned by a broader weakening of the US dollar following dovish remarks from FED Chair Jerome Powell which reinforced expectations of an imminent rate cut. Improved global risk sentiment helped by renewed optimism over US-China trade dialogue further supported the rupee’s rally. Together, these factors provided the perfect backdrop for the RBI’s intervention to gain tractions restoring calm and confidence in the forex market. The central bank’s readiness to act decisively coupled with the easing global headwinds has for now pulled the rupee back from the brink and reaffirmed its stability in the face of speculative pressure.”

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.22 per cent lower at 98.82. Brent crude was trading 0.19 per cent lower at $62.27 per barrel in futures trade.

Says Anil Bhansali, head of treasury at Finrex Treasury, “The main factor came in from the fact that Indian team had gone to the US for

trade negotiations and with rumours flying over that the deal would have been concluded and India could get tariff rates between 16-19 per cent instead of the existing 50 per cent. India may also buy oil from the US apart from Corn for ethanol and some specific dairy products. However, the details of the deals are still awaited and most of it could be speculation. The forward premiums were trading steady at around 2.21 per cent for the one-year. period. Tomorrow, rupee is again expected between 87.80 to 88.40.”