The pound headed for its longest slide in a decade as traders looked ahead to key labour market data that could bolster the case for interest-rate cuts.

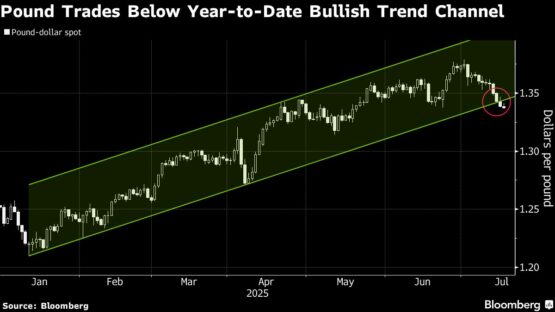

Sterling slipped 0.1% against the dollar in its ninth day of losses, taking it to a two-month low of $1.3365.

The currency shrugged off mild gains earlier on Wednesday that came after hotter-than-expected UK consumer-price data.

ADVERTISEMENT

CONTINUE READING BELOW

While a continued build-up in inflation could deter policymakers from pushing ahead with further rate cuts, traders are focusing more on the employment picture after the Bank of England’s (BoE) governor Andrew Bailey said that it could cut more aggressively if labour market data deteriorates.

Money markets are still expecting two 25 basis-point reductions this year, little changed after the inflation numbers. Yet in the options market, so-called risk reversals – a closely watched sentiment gauge – reflect the most negative outlook for the pound over the next month since February.

Credit Agricole SA analysts including Valentin Marinov now forecast the pound at $1.37 at the end of the year – up from current levels but below their previous call for a rally to $1.40. They cited risks to the UK’s finances, disappointing data and stickier inflation hurting household demand.

“We downgrade our pound outlook given that recent developments have increased the downside risks to the UK economic outlook and could thus lead to a more aggressive easing from the BoE,” they said in a note.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.