(Bloomberg) — Trading desks across Asia are buzzing with excitement again, as the region shakes off tariff shocks and attracts investors with its solid growth prospects.

Most Read from Bloomberg

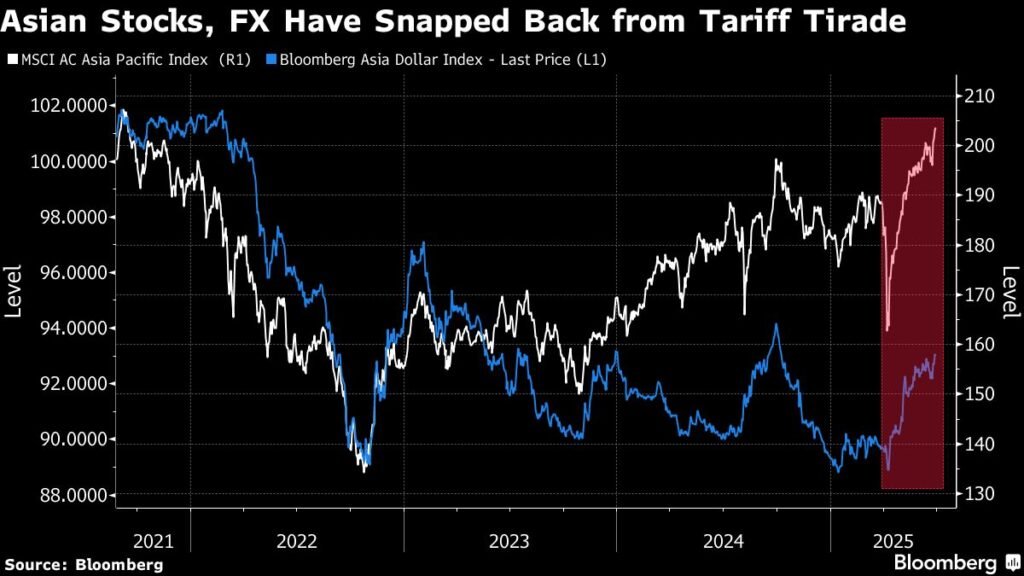

From stocks to currencies to credit, the rebound from the depths of the April market turmoil has been impressive. MSCI’s Asia equities index has jumped 25% to a four-year high, while a slump in the dollar has powered a regional currency gauge to the strongest since October. Companies are rushing to raise money to capitalize on the market’s reawakening.

It marks a sharp reversal from the jitters that prevailed just a couple of months ago, when fears of a full-blown trade war and concerns that runaway inflation will limit central banks’ policy room weighed heavily on Asian assets. Instead, a weakening dollar has created space for interest-rate cuts across the region, with the Federal Reserve’s widely-expected easing likely to provide additional tailwinds.

“Stocks have bounced back strongly from their April bottom, and investors are realizing they might have been too pessimistic about Trump’s tariffs,” said Tomo Kinoshita, global market strategist at Invesco Asset Management. “Investors are realizing they might have been too pessimistic about tariffs,” he said. “Trump is showing more flexibility around his trade policies, and that’s driving optimism.”

Take the demand for blockbuster share sales from Hong Kong to Tokyo as an example of the palpable excitement. So far, such deals across the region including initial public offerings have raised more than $90 billion, a 25% jump from this time last year, data compiled by Bloomberg show.

While Hong Kong has dominated larger deals, Japan’s capital market has also hummed along with this week, seeing the highest IPO volume since mid-March.

Debt capital markets have also roared back to life after a dearth of deals at the height of volatility. Yield premiums on Asian investment-grade dollar bonds have come down from an April high of over 100 basis points to near 76 basis points, not far off a record low reached in February, a Bloomberg index shows.

The tightening of Asian spreads is all the more impressive given a surge in dollar bond sales from the region, with this week seeing the largest volume of deals since March. Asia Pacific offerings in the US currency have climbed by about 45% this year to more than $200 billion.