Even as the Philippine peso depreciated against the United States (US) dollar at a pace that was among the worst among emerging market (EM) currencies last week, the Bangko Sentral ng Pilipinas (BSP) is still expected to cut interest rates this week.

Data from the Bankers Association of the Philippines (BAP) showed that the peso slipped back to the weaker ₱56 level versus the greenback last Friday, June 13—a development that bore the impact of Israel’s airstrikes against Iran’s nuclear program.

Friday’s close at ₱56.21:$1 was the local currency’s weakest level since April 28, when it closed at ₱56.42.

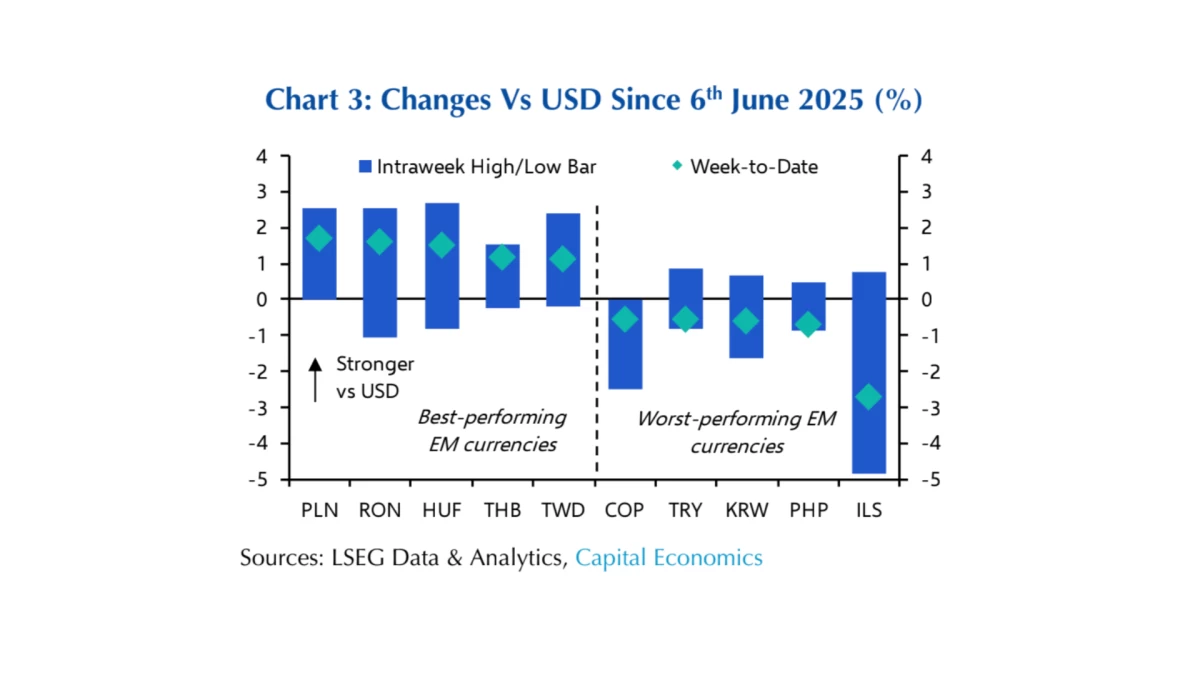

Think tank Capital Economics reported on June 13 that the Philippine peso was among the “worst-performing EM currencies” since June 6.

Capital Economics deputy chief markets economist Jonas Goltermann noted that Israel’s overnight strikes on Iran allowed the US dollar to recover “some of the ground it lost earlier [last] week,” hence strengthening against the peso and other currencies.

While the US dollar remains relatively weak, hitting an over three-year low, Capital Economics stressed that the greenback’s “safe-haven characteristics are still intact when it comes to at least some types of risk-off events.”

In its Asia FX weekly report dated June 13, Japanese financial giant MUFG Bank Ltd. also noted that the US dollar gained support from safe-haven demand after struggling recently. While it was a gain for the greenback, Asian currencies, particularly the peso, South Korean won, and Indian rupee, lost their footing due to their “sensitivity to risk and relatively higher reliance on oil imports.”

Even with this favor to the US dollar, Capital Economics senior Asia economist Gareth Leather is still looking forward to the BSP trimming the key interest rates by another quarter-point on Thursday, June 19. “Our long-held forecast is that the central bank will cut rates by a further 75 basis points (bps) this year,” he said in a separate June 13 report.

John Paolo Rivera, senior research fellow at state-run policy think tank Philippine Institute for Development Studies (PIDS), said the local currency’s depreciation to the ₱56 level “may not be a game-changer just yet,” suggesting that the widely expected cut would still push through.

But a weaker peso “does add some pressure” on the Monetary Board (MB) ahead of its policy meeting.

“While the recent trend of slowing inflation provides room for a rate cut, a weaker peso could complicate the decision, especially if it fuels imported inflation or affects market sentiment,” Rivera said. May’s 1.3-percent inflation rate was the lowest in five-and-a-half years.

Rivera argued that “if this depreciation is seen as temporary and driven by external factors (like global risk-off sentiment or a stronger US dollar), the MB may still proceed with a calibrated rate cut. But if the weakness persists or worsens, the BSP may opt to hold off on easing to maintain stability and manage inflation expectations.”

For Capital Economics, “the effects of [Israel’s] strikes may prove short-lived, at least in the absence of further escalation.” Should the Israel-Iran conflict subside soon, this would mean a weaker US dollar.

Aside from Capital Economics, Rizal Commercial Banking Corp. (RCBC) chief economist Michael Ricafort is anticipating a 25-bp cut this week, asserting that a rate cut tends to reduce the interest differential with the US dollar, a setup that could limit further declines in the strength of the local currency.

HSBC ASEAN economist Aris Dacanay pointed towards favorable inflation as the major factor to the central bank’s expected decision to further reduce key borrowing costs.

“Due to low inflation over the past two months and slow growth in the first quarter of 2025, we now expect the BSP to cut its policy rate by 25 bps to 5.25 percent [this] week,” Dacanay said. He previously projected a pause this week, considering the US Federal Reserve’s (Fed) cautious approach reducing rates.

MUFG Global Markets Research senior currency analyst Michael Wan said higher oil prices may pressure oil-importing currencies like the peso and Indian rupee. However, with manageable inflation and current account deficits, it would take a prolonged oil price surge to significantly shift the direction of Asian currencies, he said in another June 13 report.

Economists at Chinabank Research said that despite trading higher in recent days, with it hitting the highest last week, the dollar-peso exchange rate has “remained well below its historical highs, giving the BSP room to continue cutting interest rates.” This comes despite their expectation that the Fed will hold steady this week.

A total of 100 bps has been shaved off key interest rates since the kick-off of the easing cycle in August last year. The BSP has so far brought down the policy rate to 5.5 percent from 6.5 percent a year ago.

Should the BSP extend its loosening cycle by another 25 bps, the key policy rate would shrink to 5.25 percent from the current 5.5 percent.