- The US Dollar Index finished the week deeply in the red.

- Trump’s “Liberation Day” rippled across the globe.

- Next of note on the US calendar will be the Inflation Rate.

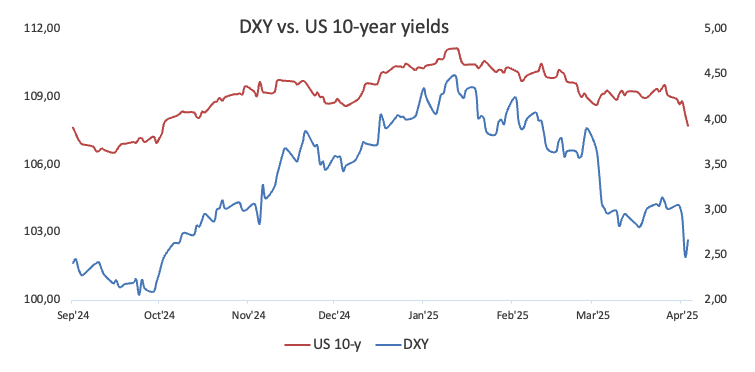

After a forgettable week, the US Dollar (USD) lost its grip, adding to the previous decline and succumbing to the sharp selling pressure that eventually sent the US Dollar Index (DXY) to the 101.30-101.20 band for the first time since early October 2024.

The steep decline in the index gathered renewed and firm pace after President Donald Trump unveiled his so-called “Liberation Day” on Wednesday, which has also reinforced the prospects of a transatlantic trade war and has lent extra legs to the idea of a US economic slowdown.

The Greenback’s intense move lower came in tandem with the equally pronounced retracement in US Treasury yields across various time frames.

Winds of change: Confronting trade turbulence and escalating prices

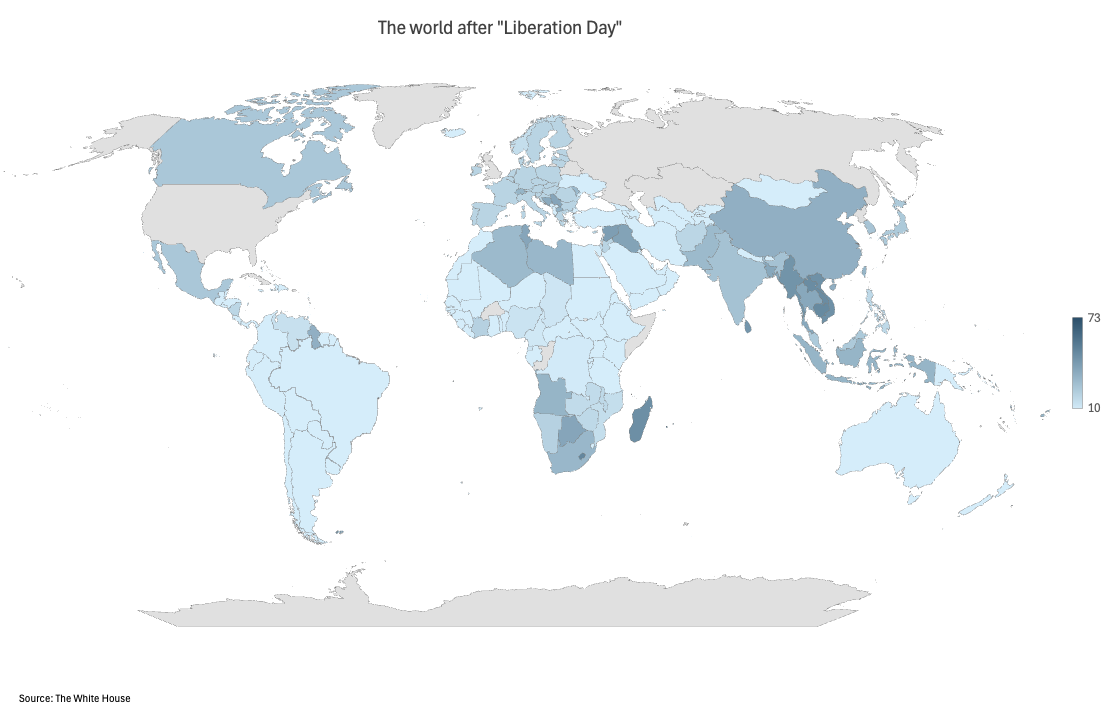

In a game-changing move, the United States unveiled its “Reciprocal Tariff to Rectify Trade Practices” plan on Wednesday.

Under this new policy, a baseline 10% tariff will apply to all imports, with additional country-specific surcharges ranging from 10% to 50%. That said, China faces a steep 34% levy on top of its existing 20% duty, while the European Union (EU) is subject to 20%, the UK to 10%, and Japan to 24%. The baseline tariffs will come into effect this Saturday, with the extra “reciprocal” rates following on April 9.

In addition, Mexico and Canada remain exempt from these reciprocal tariffs for now, thanks to a standing 25% blanket levy on any US imports not covered by the United States-Mexico-Canada Agreement (USMCA). Cars, auto parts, steel, and aluminum also stay in the clear, as they’re already taxed at 25%.

Although China, the EU, and several other countries have vowed to fight back, US Treasury Secretary Scott Bessent issued a stark warning: “I wouldn’t try to retaliate… As long as you don’t retaliate, this is the high end of the number.”

So, what’s the reasoning behind tariffs? Initially, higher import duties tend to trigger a short-lived spike in consumer prices—a one-time shock that’s unlikely to immediately force the Federal Reserve’s (Fed) hand. However, if these tariffs stick around or escalate, businesses might have little choice but to keep prices elevated, whether because competition dwindles or they seek larger margins.

This second wave of price hikes could eventually slow consumer spending, dampen economic growth, hit employment, and even revive deflationary risks. Over time, these cascading effects might push the Fed toward more forceful policy measures.

Steering through economic deceleration and rising inflation

The increasing weakness surrounding the US Dollar has been spurred by growing speculation of an economic slowdown, fueled by newly announced tariffs, tepid results from US fundamentals, and eroding market confidence.

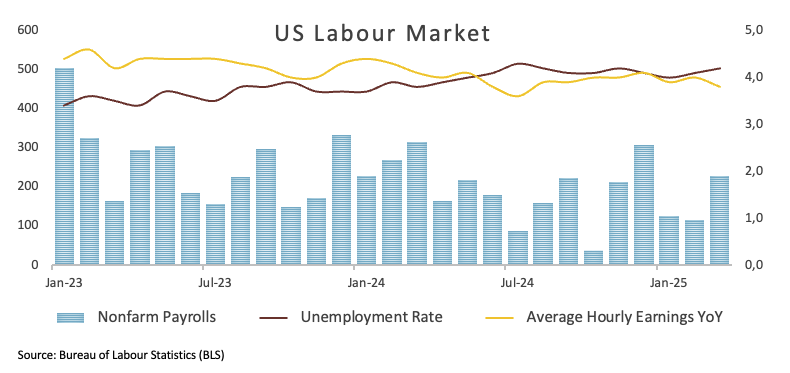

While inflation still runs above the Fed’s 2% target—evident in both CPI and PCE figures—a resilient and robust labor market adds an intriguing twist to the story.

In the end, this blend of factors, combined with rising uncertainty over the impact of US tariffs both domestically and overseas, is expected to maintain the volatility in the Greenback, leaving conditions anything but mitigated.

Measured moves: The Fed’s prudent response to market uncertainty

On March 19, the Federal Reserve wrapped up its meeting by keeping the federal funds rate anchored between 4.25% and 4.5%.

Citing heightened uncertainty—from shifting policies to rising trade tensions—the Committee opted for a cautious stance. At the same time, it revised its 2025 forecasts, lowering real GDP growth from 2.1% to 1.7% and nudging inflation expectations up from 2.5% to 2.7%. These adjustments highlight growing worries about a stagflation threat, where slow growth intersects with higher inflation.

During his customary press conference, Fed Chair Jerome Powell reiterated that there is no immediate need for additional rate cuts.

In a flurry of insights from top Federal Reserve officials, policymakers painted a picture of cautious optimism amid mounting economic risks.

That said, New York Fed President John Williams noted that policy is “well positioned” and “moderately restrictive,” allowing for careful data monitoring before any rate changes.

Richmond Fed President Thomas Barkin and Chicago Fed President Austan Goolsbee both highlighted inflation risks from tariffs, with Barkin emphasizing that rate cuts would depend on inflation trends and Goolsbee warning that new tariffs could spark renewed inflation or slow growth.

Fed Governor Adriana Kugler and Vice Chair Philip Jefferson also stressed that until inflation risks subside, keeping rates steady is the prudent course of action, while Fed Governor Lisa Cook urged the Fed to wait and watch emerging data before making further adjustments.

In addition, Federal Reserve Chair Jerome Powell warned on Friday that President Donald Trump’s new tariffs are “larger than expected,” and he predicted that the resulting economic fallout—including higher inflation and slower growth—will likely be just as significant. He remarked, “We face a highly uncertain outlook with elevated risks of both higher unemployment and higher inflation,” a scenario that could jeopardise the Fed’s twin mandates of 2% inflation and maximum employment. He emphasised that while it isn’t the Fed’s role to critique the Trump administration’s policies, its duty is to react to their impact on an economy that, only weeks ago, was enjoying a “sweet spot” of falling inflation and low unemployment

The road ahead for the Greenback

Next week, all eyes will be on the release of the US Inflation Rate figures and the unveiling of the FOMC Minutes from the March 18-19 meeting. Fed officials are also expected to offer some spirited commentary that could add an exciting twist to the unfolding economic narrative.

Charting the US Dollar Index

The US Dollar Index (DXY) remains technically under heavy pressure, trading below its key 200-day Simple Moving Average (SMA) of 104.86, which underscores a bearish sentiment.

The downward bias accelerated this week, prompting DXY to now face its immediate support at its 2025 floor of 101.26 (April 3) and further down at the 2024 trough of 100.15 (September 27), just shy of the crucial 100.00 level.

On the other hand, a much-needed rebound could push the index back to last week’s high of 104.68 (March 26) before testing the 200-day SMA. Beyond that, the next hurdles are the provisional 55-day and 100-day SMAs at 105.91 and 106.63, respectively, seconded by the weekly high of 107.66 (February 28), the February peak of 109.88 (February 3), and ultimately the 2025 top of 110.17 (January 13).

Meanwhile, momentum indicators do not rule out further retracements in the near term: the daily Relative Strength Index (RSI) has rebounded to the area above 34, while the Average Directional Index (ADX) has advanced to approximately 34, suggesting that the current trend may be gaining some steam.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.