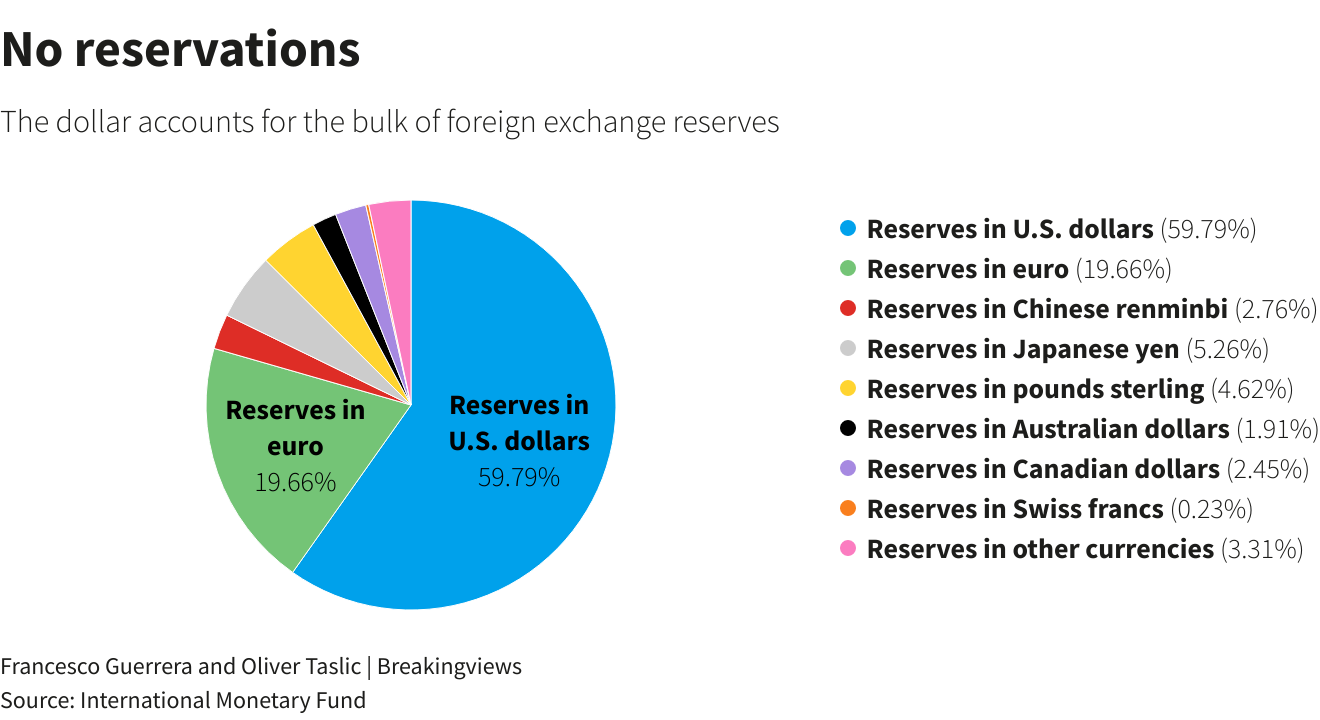

LONDON, Feb 28 (Reuters Breakingviews) – Reports of the dollar’s demise are greatly exaggerated. An erosion in the greenback’s share of global foreign exchange reserves, combined with rising geopolitical tensions, have rekindled talk of an end to the U.S. currency’s dominance. In fact, its lynchpin status remains unshaken. The outsized role played by the United States in capital markets, trade and debt reinforces the status quo. Unless the global economy undergoes a complete overhaul, the dollar will remain on top.

Meanwhile, the U.S. share of the world economic output has fallen from 32% in 1980 to 24% in 2020, according to calculations by the U.S. Federal Reserve, while the country’s share of global trade dropped from 14% to 11% in the same period.

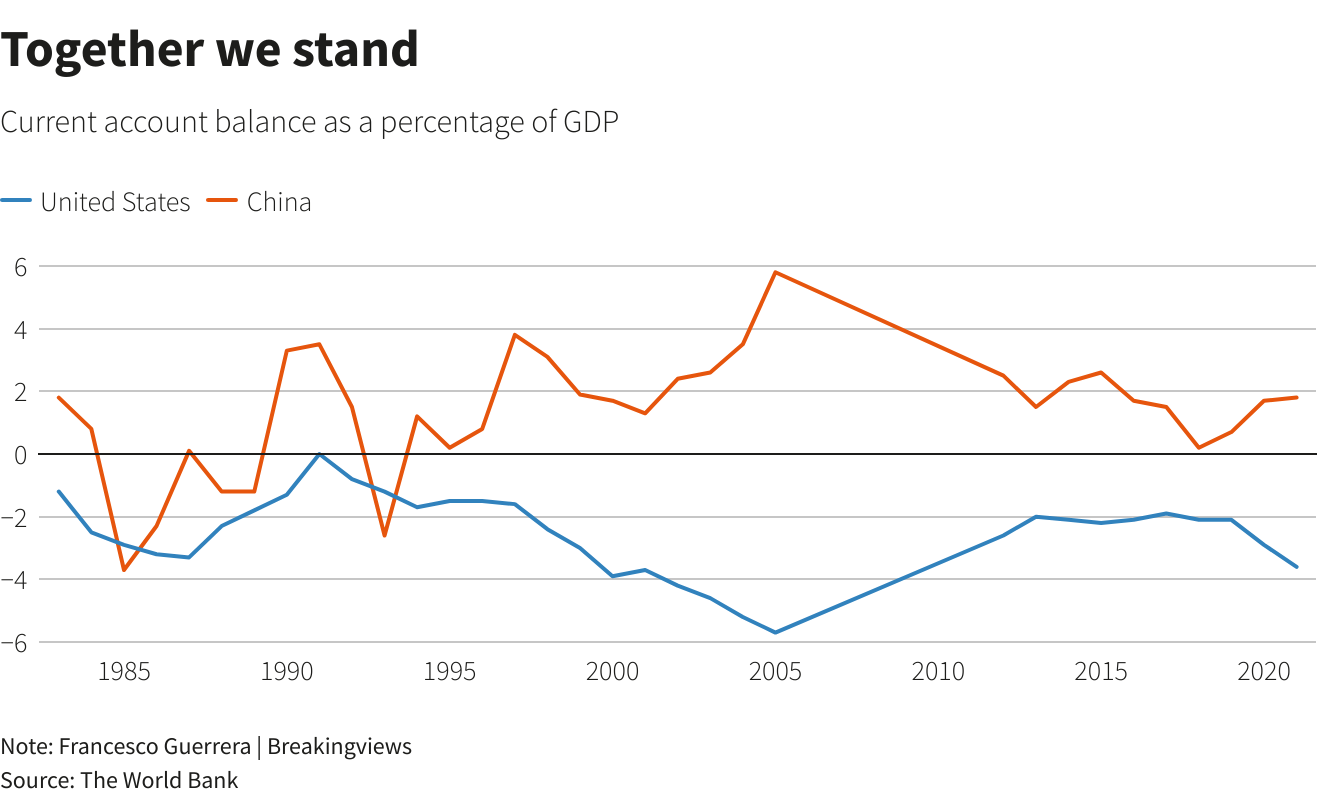

Structural factors also help. U.S. capital markets are deep and liquid enough to absorb the savings of emerging and developed countries. The proceeds of an international “savings glut” are therefore recycled into U.S. assets.

The trigger for this cycle is often an interest rate increase by the U.S. central bank, the Fed researchers found. What puts an end to it is the fact that, eventually, global weakness in the manufacturing sector spills over into U.S. production. Rate rises also lead to tighter financial conditions for companies and households, slowing down the U.S. economy. The central role of the dollar in capital markets, however, discourages investors from fleeing the United States, ensuring that the cycle soon starts again.

The period between December 2015, when the Fed raised rates, and December 2018, when the official cost of borrowing peaked at 2.25%-2.50%, illustrates the point. The dollar rose around 10% against other major currencies between mid-2015 and the beginning of 2017. During that period, manufacturing growth in the United States – measured by purchasing managers’ index surveys – outstripped that of the rest of the world while financing conditions overseas tightened. By mid-2017 the circle closed as U.S. manufacturing slowed down, domestic financial conditions tightened, and the dollar weakened.

Of course America cannot take its key role in global capitalism for granted. The weaponisation of the dollar, geopolitical tensions with China and the United States’ own political failings – from elected representatives disputing the results of the 2020 presidential election to squabbles over the debt ceiling – have increased the desire for alternatives.

In the past such financial revolutions have generally coincided with other upheavals such as world wars. In the absence of such a seismic shift, King Dollar will remain on its throne.

(The author is a Reuters Breakingviews columnist. The opinions expressed are his own. Updates to add charts.)

CONTEXT NEWS

Chinese President Xi Jinping told Gulf Arab leaders on Dec. 9 that his country would work to buy oil and gas in yuan, the latest attempt by Beijing to weaken the U.S. dollar’s grip on world trade.

A Saudi source, speaking before Xi’s visit, told Reuters that a decision to sell small amounts of oil in yuan to China could make sense, but “it is not yet the right time”.

For more insights like these, click here to try Breakingviews for free.

Editing by Peter Thal Larsen, Oliver Taslic and Pranav Kiran

Breakingviews

Reuters Breakingviews is the world’s leading source of agenda-setting financial insight. As the Reuters brand for financial commentary, we dissect the big business and economic stories as they break around the world every day. A global team of about 30 correspondents in New York, London, Hong Kong and other major cities provides expert analysis in real time.

Sign up for a free trial of our full service at https://www.breakingviews.com/trial and follow us on Twitter @Breakingviews and at www.breakingviews.com. All opinions expressed are those of the authors.